It’s National 529 Day… What’s Your College Savings Plan?

Before you get into full summer vacation mode, let me be the first to wish you a Happy National 529 College Savings Plan Day!

Celebrating 529 plans on 5/29…. Get it?

This should come as a shock to no one, but college is expensive. The prices of tuition are going up every year. Most families will have to use a combination of tactics to fund their children’s higher education costs, including:

– Applying for grants and scholarships

– Cashing in some investments or savings

– Reducing standards of living (i.e. skip vacations, eat out less, etc.)

– Borrowing money

Everybody’s financial situation is different, which is why everyone should consult with a Certified Financial Planner® pro to determine which ratio of options works best for your family. However, a 529 plan can play a key role in financially preparing for college.

What is a 529 Plan?

A 529 college savings plan is a qualified tuition program established under Section 529 of the Internal Revenue Code. They are available to every single family, regardless of annual household income. There are a variety of 529 plans out there, and the rules (and tax benefits!) for each plan vary by state.

The purpose of a 529 plan is to save money for college in an investment account that features tax-deferred growth and tax-free withdrawals. “Tax-deferred growth” means you don’t have to pay federal income taxes on your interest earnings.

The withdrawals stay tax-free, as long as the money is used on “qualified education expenses.” This usually includes tuition, fees, books, computers, and internet. It sometimes includes room and board, but you need to verify that with your specific plan.

Your 529 account funds can be used at any college accredited by the U.S. Department of Education. This covers undergrad, graduate school, trade schools, and even some foreign colleges.

Who Can Open a 529 Plan?

Anyone with a Social Security number and a permanent address can open a 529 plan, and name a beneficiary (aka. the future college student). Once the plan is open, anybody can make a contribution.

Who Controls the Money?

There are 2 main roles in a 529 account:

1) Account Owner: the person who opened the account. They decide when withdrawals are made. (Sometimes this person is called the “participant.”)

2) Beneficiary: the person who uses the money to pay for qualified education expenses. The beneficiary can change over time.

The account owner has complete legal ownership of the money in the 529 plan, NOT the beneficiary- even after the beneficiary turns 18 years of age. Anyone who has ever met a teenager understands why this is a good idea….

Crowd-Source Your College Savings

Families have started “crowd-sourcing” their college savings funds by encouraging grandparents, uncles, aunts, etc. to make contributions as a birthday or holiday gift. After all, does the kid really need another stuffed animal or video game?

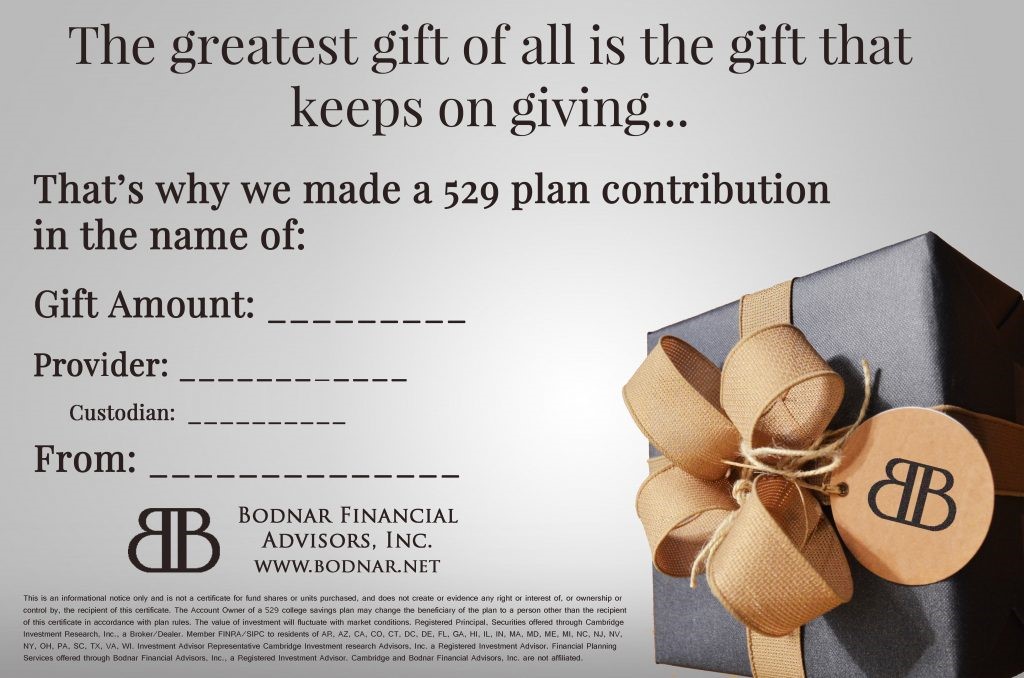

Bodnar Financial provides “529 gift certificates” for people who want to give the only gift card that gets MORE valuable over time:

We also provide thank-you cards for parents that list the “true value” of the 529 contribution, thanks to compound interest. Nothing motivates family members to give more than seeing how much a contribution grows over the years!

Where do I open a 529 plan?

Everybody’s financial needs are different. If you are considering a 529 plan, contact Bodnar Financial to make sure it’s a good fit for your family.

In the meantime- Happy 529 Day!