5 Ways to Immediately Boost Your Retirement Savings

According to surveys, a jaw-dropping 57 percent of Americans have less than $1,000 in their retirement accounts. Believe it or not, that number has improved by 12 percentage points since 2016, but it’s still way too high.

You don’t have to make a ton of money to have a retirement plan. If you begin saving early, the miracle of compound interest will carry you most of the way.

Making tiny changes can have a BIG impact on your retirement account in the long run. Below are 5 simple actions you can take right now to exponentially increase your nest egg by retirement age.

1) Maximize your 401(k) match at work

Some employers offer a 401(k)-contribution match, which means your boss agreed to match your pre-tax contributions up to a certain limit. In other words, your employer is saying, “If you put money in, I’ll put money in too!” up to a certain point.

The match varies from employer to employer, so ask your HR department if you don’t know what it is. Some people choose not to meet the company’s match limit, opting instead for a few extra bucks in take-home pay. There is a scientific term for these people: FOOLS.

If you’re not contributing the maximum match into your retirement plan, you are leaving free money on the table. You are also missing out on years and years (and did I mention years?) of compound interest making that money grow.

Quick Tip: While you are checking on your employer match policy, use this opportunity to revisit your portfolio distribution. For younger folks, I recommend keeping your distribution as aggressive as possible (aka. stocks). Personally, if I could go back in time and do it all over again, I’d have 100% stocks in my distribution. Are they more volatile? Yes. But do they historically demonstrate a higher rate of return in the long term over any other investment? Absolutely.

It’s a good idea to find out when you become fully vested in your 401(k) plan. Some companies offer immediate vesting, but most employer match contributions do not become fully available until you work a certain amount of years at the company.

The time frame is determined by the company at the start of your employment. Beware: leaving your job too early can cost you big money! I hear stories all the time about people who left their jobs and could have taken thousands of dollars in retirement savings with them, if only they kept their jobs for a few weeks longer. Educate yourself on the company 401(k) policy to avoid this tragedy.

2) Add another 2% to your 401(k) contribution

Financial experts recommend saving 12-15% of your annual salary for retirement. Yet, the average 401(k) contribution rate hovered around 6% in 2016, according to Vanguard. If you can afford it, bump your annual contribution rate up to 15% or more.

If you don’t have the cash flow to make the jump to 15% right away, increase your contribution rate by 2% each year until you reach your goal. Increasing your contribution by even a few percentage points will make a big difference in the long run.

In 2019, the contribution limit for 401(k) plans increased to $19,000. If you contributed $19,000 each year for 35 years (with a 6% average annual return), you would accumulate around $2.25 million by retirement.

Note: If you picked a more aggressive 401(k) portfolio distribution (aka. stocks), you could expect an even bigger result. Contributing $19,000 each year for 35 years with a 10% average annual return (which is average for the S&P 500), would accumulate around $5.66 million. That doesn’t even include the employer match.

3) Set up automatic deposits into investment and retirement accounts

Most people already have auto-bills linked to their credit cards and checking accounts. Why not schedule auto-savings to go along with them?

Setting up a monthly transfer from your checking account to a Traditional or Roth IRA puts your retirement plan on autopilot. It allows you to budget for retirement contributions as if they were just another monthly bill. The maximum allowed IRA contribution will be $6,000/year in tax year 2019, with an additional $1,000 catch-up contribution for individuals age 50 and older.

Even if you start by transferring a small $50-100 contribution each pay period, you’ll be shocked by how quickly it grows with interest while you’re not looking. A bonus for Traditional IRA account holders: you can deduct those contributions at tax time.

4) Open a college savings plan for children

Opening a 529 plan for your children’s college education – and contributing early and often – can save you thousands of dollars in retirement. Some investment companies predict the cost of a public university degree will be $184,000 in 2036. The cost of a private university degree is predicted to be $303,000 in 2036.

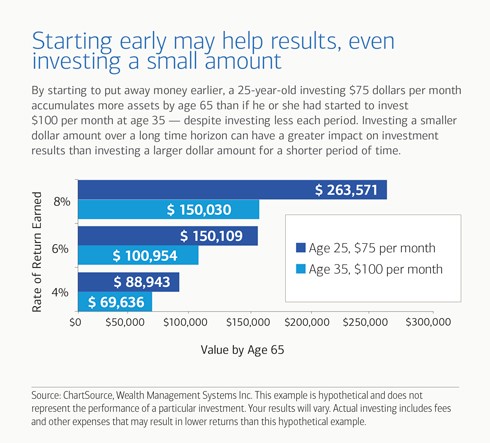

A 529 plan is another opportunity to let compound interest work in your favor. Smaller contributions made over a longer period could see greater returns than larger contributions made over a shorter period.

In other words, by getting in early, you pay less money overall to get more. That could free up tens of thousands of potential retirement dollars in the long run.

5) Delay Social Security for as long as possible

The longer you wait to claim Social Security benefits, the higher your monthly payment will be. Full Retirement Age (FRA) is the age the U.S. government decides you can claim full, unreduced Social Security benefits. This used to be age 65 for everyone, but now varies depending on your birth year.

Claiming Social Security before FRA reduces your benefit by a percentage, depending on when you apply. Claiming after FRA increases your benefit by a percentage (until age 70).

Note: Your benefit stays at this percentage for life. If you are in good health and you can afford it – file later. It literally pays to wait… about 8 percent per year, to be exact. Not bad!

Small changes make a big difference. Contact the office to make sure you’re saving for retirement in the most efficient way possible!