It’s Not Too Late: Tips for Retirement Planning in Your 50s and 60s

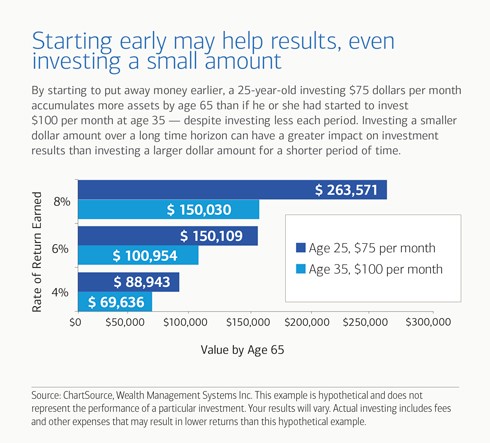

Starting early with your retirement plan can have major benefits in the long term. Time allows you to take advantage of compound interest, the opportunity to earn interest on your interest.

Translation: Investing smaller amounts of money over a longer period (aka. early in life) may have a larger return than investing larger amounts over shorter periods (aka. later in life).

Of course, investing early and often is the ideal scenario. But sometimes life gets in the way.

Maybe you lost a job or dipped into the nest egg to pay your child’s college tuition. Maybe a loved one got sick and financial priorities changed.

A late start to retirement planning is not a lost cause. It’s NEVER too late to start saving for retirement. Make sure you’re getting the most out of your financial strategy in the final years leading up to retirement age with these helpful tips.

Take advantage of IRA and 401(k) catch-up contributions

The government limits how much you can sock away in an IRA and 401(k) each year. Here are the limits as of 2019:

| Plan Type | Annual Contribution Limit |

| Traditional and Roth IRA | $6,000 |

| 401(k), 403(b), 457(b), Roth 401(k) | $19,000 |

| SIMPLE plans | $13,000 |

| Health savings accounts (individual) | $3,500 |

| Health savings accounts (family) | $7,000 |

Individuals ages 50+ can put extra money away with catch-up contributions. These special contributions allow those nearing retirement age to make up for lost time with extra payments each year.

Anyone age 50 and over can make catch-up contributions, even if they have been maxing out their contributions all along. Here are the catch-up contribution limits as of 2019:

| Plan Type | Catch-Up Limit (for age 50+) |

| Traditional and Roth IRA | $1,000 |

| 401(k), 403(b), 457(b), Roth 401(k) | $6,000 |

| SIMPLE plans | $3,000 |

| Health savings accounts | $1,000 |

Keep investing while you pay off debt

Saving for retirement and paying off debt should be a one-two punch, not an either-or scenario.

Let’s say hypothetically, you created a monthly budget and realized you have extra cash left over. Or maybe you received an inheritance, or pay raise at work, or a large tax refund. Many clients ask me: Should we use that money to save for retirement or pay down debt?

There is an economic term called “opportunity cost.” It means if you are doing one thing, you can’t do another thing. In other words, if you spend a Saturday sleeping in, it means you can’t go to your Saturday morning spin class at the gym. You just can’t do it all.

We face a similar challenge here. There are only so many dollars to go around. Personally, I like to attack debt, especially credit card debt. The interest rates are insane, and you don’t get any tax benefits for paying them like you do with mortgage interest and student loan interest.

Every financial situation is different. If it were me, I would:

- Max out my 401(k) match at work

- Save up six months of living expenses in my rainy-day fund

- Then split the leftover money

- Half to attack credit card debt

- Half to make catch-up contributions/ invest in other funds

In my scenario, I am assuming there is enough cash to pay down principal debt after I split the money in half. However, if you find yourself just paying credit card interest and no principal, it’s not worth it.

In that case, I would maximize my 401(k)-employer match, skip the catch-up contributions for now, and focus all my extra money on attacking that credit card debt until it’s gone. But that’s just me.

Make your portfolio more aggressive

Most retirement experts predict you will need about 80 percent of your current income in retirement (not including annual cost-of-living increases). They argue retirees no longer have expenses like commuting costs, mortgage payments, and taking paycheck money to save for retirement itself. Therefore, they will need less money to maintain their lifestyle than before.

This is not necessarily true. The “80% salary replacement rule” could be too low or too high depending on your current income, health, tax bracket, and anticipated retirement lifestyle.

Retirement is a permanent vacation. In the words of my father, “Retirement is great! Every day is a Saturday.” While a permanent vacation sounds great for the mood, it can be dangerous for the wallet.

Weekends and vacations are the times we spend the most money on travel, day-trips, eating at restaurants, going to concerts and shows, going to the movies, walking around the mall, etc.

If all your money is sitting in traditional savings accounts and bonds, you are not going to be able to keep up with inflation, let alone your new spending habits. Consider meeting with a financial advisor to make sure your portfolio is aggressive enough to grow with you in retirement.

Claim Social Security as late as possible (until age 70)

The longer you wait to file for Social Security, the higher your benefit will be. This is true until you turn 70 years of age.

Full Retirement Age (FRA) is the age the U.S. government decides you can claim full, unreduced Social Security benefits. This used to be 65 for everyone, but now varies depending on your birth year.

Claiming Social Security before your full retirement age reduces your monthly benefit by a percentage, depending on age. Claiming after your full retirement age increases your monthly benefit by a percentage (until age 70).

Your benefit stays at this percentage for life. If you are in good health and you can afford it, file later. It literally pays to wait… about 8 percent per year, to be exact.

Meet with a New Jersey Financial Planner

Everyone’s financial situation is different. The retirement strategy that works for your family probably wouldn’t work for your neighbors.

A financial planner can help you:

- Assess your current financial situation

- Calculate your expected cash flow in retirement

- Create a debt payment strategy

- Identify all possible retirement contributions and tax benefits

- Create a long-term financial plan

The only thing worse than getting old, is getting old and running out of money.

Bodnar Financial can help you plan with financial peace of mind.