Health Savings Accounts Can Be More Valuable Than 401(k)s and IRAs

Health savings accounts (HSA) are a little-known secret weapon of financial planning. They let families save up money on a pretax basis to pay for “qualified medical expenses,” which can include deductibles, copays, prescriptions, and more.

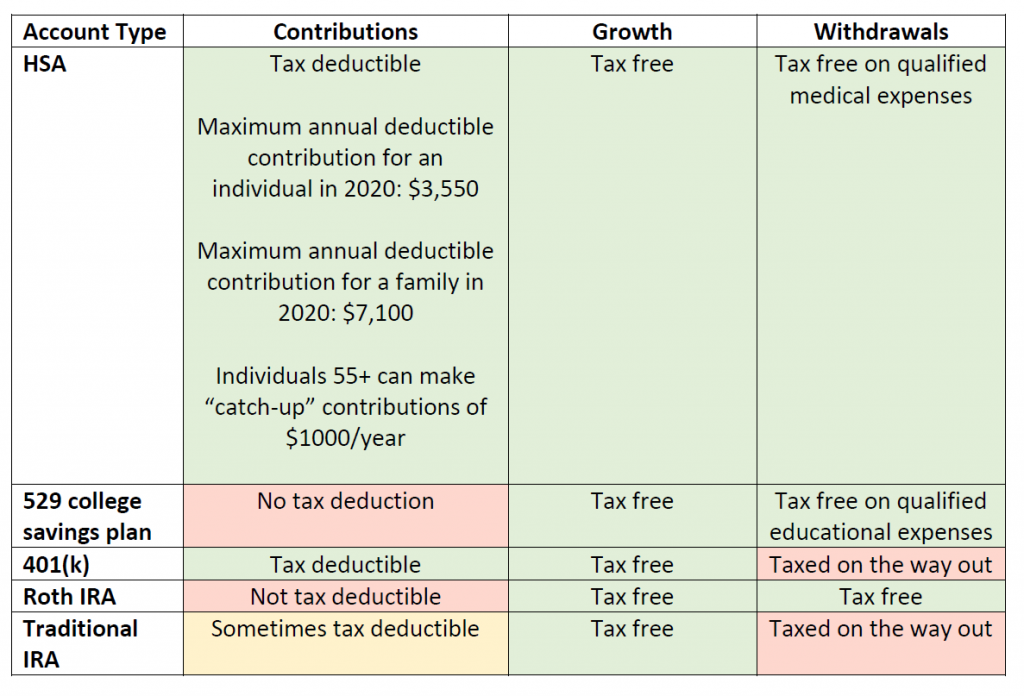

There are several reasons why the HSA is awesome. For starters, contributions made to the HSA are tax-deductible at the federal level. Growth in the account is not taxed. And when it’s time to pay for qualified medical expenses, those withdrawals are not taxed either.

There is nothing else like it! I challenge you to find me another investment account that checks all three of those boxes.

Clients often ask me, “If I have extra cash, should I invest in a 401(k) or IRA?” And my answer is, “It depends. But do you qualify for an HSA?” There are going to be trade-offs, no matter which one you pick. It just depends what priorities matter most to your specific financial situation.

Why would you pick a 401(k) over an HSA? The employee match is higher, and the annual contribution limit is higher.

Why would you pick a Traditional IRA or Roth IRA over an HSA? If you don’t have enough money saved for retirement, and your employer does not offer a 401(k).

Why would you pick a 529 plan over an HSA? If you are focused on saving for your kids, and not for yourself or your spouse.

But if you are looking for the ultimate, triple-tax advantaged account? It is the HSA, all the way.

How Does a Health Savings Account (HSA) Work?

To open and contribute to an HSA account, you must have a high-deductible health plan (HDHP) and not be enrolled in Medicare. How do you know if you have one? In 2020, the minimum deductible for an HDHP is $1,400 for an individual and $2,800 for a family. The maximum out-of-pocket expenses for an HDHP in 2020 will be $6,900 for an individual and $13,800 for a family.

In an HSA, the account owner can make tax-deductible contributions. An employer-sponsored match contribution is not deductible, but it is excluded from your taxable income, and that’s not nothing. If the account holder changes employers, they can take the HSA with them—even if the employer made contributions into the account in the past. It is totally portable.

Funds in the HSA can be spent on “qualified medical expenses” for the account owner, their spouse, and their dependents tax-free.

Qualified medical expenses do not generally include health insurance premiums. However, they do include “medical expenses related to diagnosis, cure, mitigation, treatment or prevention of disease.” They also include payments made to doctors and dentists. The IRS updates a list of qualified medical expenses here.

For out-of-pocket medical expenses, you can use the HSA to pay yourself back after-the-fact. Just be sure to keep the receipts.

If you decide to take HSA distributions for purposes other than qualified medical expenses, those funds will be considered income for tax purposes, and the account owner will face an additional 20% penalty. The penalty will be waived only if the account owner is dead, disabled, or reaching age 65.

Any funds not used during a year can be carried over into the next year with no penalty. Even if you no longer have a high-deductible health plan at your new job and are no longer eligible to make contributions into the HSA, you will still have access to the funds that are already in there.

When Can I Make HSA Contributions?

Contributions must be made on or after Jan. 1 of the year to which they apply, and before the due date for filing your federal income tax return for the year. For example, your 2019 HSA contributions can be made between Jan. 1, 2019 and April 15, 2020.

Attention Parents and Grandparents!

Did you know that any individual—including family members—can make contributions into a person’s health savings account? Not only that, but qualified contributions made by family members are tax-deductible from the account owner’s gross income. It’s the gift that keeps on giving! Just don’t give too much—contributions beyond annual limits are subject to a 6% tax.

Getting Buyer’s Remorse from Opening an IRA Yet?

There is a once-in-a-lifetime provision that allows an eligible individual to do a direct trustee-to-trustee transfer from a Traditional or Roth IRA into an HSA without facing the 10% early distribution penalty.

You can distribute up to the maximum annual deductible contribution limit, although keep in mind, the contribution itself will not be deductible. There is one catch—you have to remain an “eligible individual” to make HSA contributions for 12 months, otherwise the funds you transferred will be considered taxable income and face an additional 10% tax.

Work with a New Jersey Financial Planner

Keep in mind, all of the tax benefits listed above apply at the federal level—but every state has a different set of rules. New Jerseyans will not be surprised to learn that as of 2019, the Garden State does not offer tax-free contributions at the state level.

The rules of any investment account can be complex. It is a good idea to consult with a financial planner to make sure your investment decisions line up with your long-term financial goals.