A Guide to Coronavirus Relief for Individuals and Families

On March 27, the $2 trillion ‘Coronavirus Aid, Relief, and Economic Security (CARES) Act’ was signed into law. The purpose of the bill was to rescue the economy and the millions of Americans struggling with mandatory business closures as a result of the coronavirus pandemic.

The law is stuffed with billions of dollars in loans, grants and direct payments to help people who have lost their jobs, small and medium-sized businesses, big businesses hit especially hard by the coronavirus, medical care providers, and states and localities battling the crisis.

Below is a list of the CARES Act programs and benefits that may be of particular interest to our clients.

CARES Act Benefits for Individuals and Households

Direct Payments to Individuals

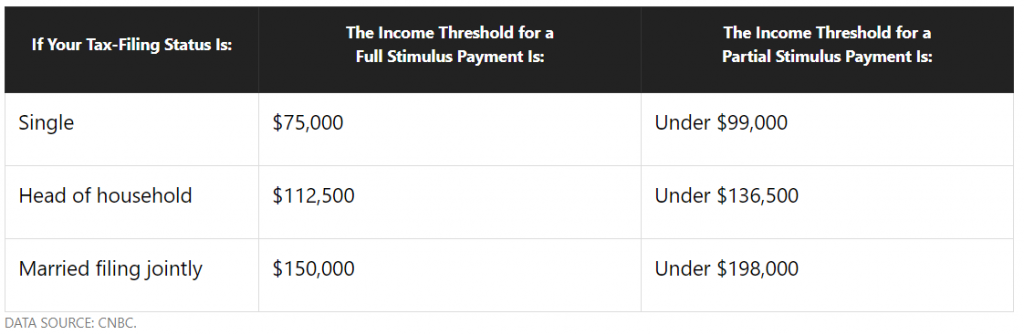

Americans will receive cash payments directly from the Treasury by direct deposit or check. The amount of the payment will be $1,200 per person with income under $75,000 per year, and $2,400 for a married couple filing jointly with income under $150,000 per year (or $112,500 for a head of household). An additional $500 will be paid for each dependent child age 16 or under.

People with incomes above these levels will receive a payment reduced by $5 for every $100 by which their income exceeds the limits. Payments are fully phased out at incomes of $99,000/single and $198,000/married. If you have not filed your 2019 taxes, your 2018 tax return will be used to determine the amount of money you receive.

Tax Filing Deadlines Extended

The federal tax filing and payment due date has been extended from April 15 to July 15, 2020. This extension is automatic to all Americans—no paperwork required. This new tax deadline does NOT apply to payroll taxes, estate taxes or excise taxes.

All 41 states with a personal income tax have extended their deadlines to follow suit, though the new dates will vary by state. New Jersey and New York have both extended their tax filing and payment deadlines to July 15, 2020.

If you are making estimated quarterly payments: The new July 15 federal tax deadline also applies to first-quarter taxes, which are normally due on April 15. Oddly enough, the second-quarter payment deadline of June 15 remains the same. So, many of you might be paying Q2 before Q1 this year.

IRA Contribution Deadline Extended to July 15

The deadline for making 2019 prior-year IRA contributions has been extended to July 15. This is good news for retirement savers, because it gives us more time to get prior-year contributions done. To avoid confusion, it should be clearly indicated to the IRA custodian the amount contributed is a 2019 prior-year contribution.

And remember—you can fund 2020 right now as well. Most people wait until their CPA gives them a number to contribute into their IRA. If you don’t have that number yet, let’s estimate 80% of it, and consider doing 50% of it for 2020. Don’t wait until 2021 to make your 2020 contribution. Make a portion of it now, and give your contribution more time to grow.

Required Minimum Distributions (RMD) Waived for 2020

Individuals are not required to make RMD withdrawals from company savings plans and IRAs in 2020. This includes traditional and Roth inherited IRAs. Those who turned age 70 ½ in 2019 who have NOT already withdrawn their first RMD payment are also excused. (Remember—the deadline for taking RMDs is Dec. 31, but it has a special deadline of April 1 for the first withdrawal only. So, it is possible some people have not made their first withdrawal yet.) If you are one of these procrastinators, lucky you!

If an RMD has already been withdrawn in 2020, the participant may avoid taxes by doing a roll-over within 60 days, either into a new plan or back into the existing plan. But, if you turned 70½ in 2019 and the distribution was taken in 2019, or you have already done a rollover in the last 12 months, no dice.

Early IRA Withdrawal Penalty Waived

For those below age 59 ½ who have been directly impacted by COVID-19, the 10% penalty on early distributions up to $100,000 from IRAs and other retirement plans is waived. This means people of all ages can withdraw up to $100,000 from their IRA without penalty. The income tax is not waived. However, the income tax can be spread over a three-year period, and you have the option to avoid taxes by repaying some or all of the money back into your retirement account within three years.

401(k) Loans Increased to $100,000

The CARES Act permits those who have been directly impacted by COVID-19 to borrow up to $100,000 from a 401(k) or 403(b) plan. The loan must be taken within six months of the enactment of the CARES Act, which was March 27, 2020.

Qualified individuals include: people diagnosed with SARS-CoV-2 or COVID-19, those with spouses who tested positive, those in financial hardship due to quarantines and mandatory closures, and those unable to work because they are caring for children during school closures.

Currently, anyone can borrow up to $50,000 on their 401(k) and 403(b) retirement plans. But you will need to be a “qualified individual” to receive the extended loan of $100,000.

Participants will not owe income tax on the amount borrowed from the 401(k) if it’s paid back within five years—actually six years, because loan repayments normally due in 2020 can be delayed for a year, also thanks to the CARES Act.

Does your brain hurt yet?

401(k) Hardship Distributions up to $100,000

Qualified individuals can withdraw up to $100,000 from a 401(k) or 403(b) plan through a hardship distribution taken in 2020. This is technically different from the loan described above.

This income will still be taxed, but you can spread the federal income tax burden over three years, or repay the withdrawal tax-free within three years. If you have already paid taxes on a withdrawal that you later decide to repay, you can file an amended tax return to recover the taxes.

If you are below age 59 ½ and considered a “qualified individual,” you can withdraw this money without the usual 10% early distribution penalty.

Note: this law permits workplaces to allow hardship distributions from employee retirement savings, but they need to give the green light first. Before you take any withdrawals, you should talk to your HR department or plan administrator first.

Withdrawing funds from your retirement plans should be an absolute, last resort, emergency measure—especially while the markets are down. You really want to keep that money in your account to experience the economic recovery, and continue to grow at a faster pace than inflation. Remember, pandemics and recessions are temporary, but retirement is forever.

Unemployment Benefits Extended and Increased by $600/week

Unemployment benefits will increase by $600 per week until July 31, 2020, courtesy of the federal government. New Jersey anticipates that people already collecting unemployment can expect to receive their extra $600 benefit by April 14 (for the week of March 30), but we shall see. It should arrive in a separate payment.

When state funds are no longer available, the CARES Act also provides an additional 13 weeks of unemployment assistance for those who remain unemployed.

More people qualify for unemployment benefits than ever before. The CARES Act expanded eligibility for unemployment compensation to gig workers, freelancers, independent contractors, and other self-employed individuals.

It also covers furloughed employees, people who cannot work because of mandatory closures, people who quit their job as a direct result of COVID-19, people diagnosed with COVID-19, people living with or providing care for an individual diagnosed with COVID-19, and people caring for children due to school closures.

This is complicated stuff, and the news is updating constantly. If you are considering any of these options, please contact the office for guidance.