2022 Annual Client Letter

In what has become a Bodnar Financial tradition, allow me to be the very last person to wish you a Happy New Year!

New year, same volatility fatigue. The stock market had a third straight year of growth in 2021, but the road was bumpy—omicron, inflation, and congressional drama proved once again that Wall Street climbs a wall of worry.

January is the time of year when the market mystics dust off their crystal balls and try to predict the future, but seasoned Bodnar Financial clients already know better. We don’t do forecasting here. Instead, I have divided this letter into three parts:

- Restating the timeless principles that guide our shared investment philosophy

- Sharing my perspective on the current state of the economy and the markets

- Revisiting an exercise that I like to call “Lifeboat Drills” to help investors normalize and prepare for market corrections that are to be expected, not avoided

Part One: Our Shared Investment Principles

We are long-term, goal-focused, plan-driven investors. We believe the key to lifetime success in equity investing is to act continuously on a specific, written plan. These plans are not influenced by the news or the closing value of a stock on a given day—we never try to time the markets.

Instead, we define personal goals, build a long-term investment plan, and fund it with a responsible portfolio. Then we stay the course, so long as your goals have not changed.

Every successful investor I’ve ever known acted continuously on a plan. Failed investors react to current events. The more they tinker with their portfolios in response to fears and fads, the worse their long-term results.

This is where my real work begins—managing the emotional side of money. Investing is a brutally counterintuitive practice. My job is to coach investors away from taking short-term (and fear-based) actions that will sabotage their financial goals.

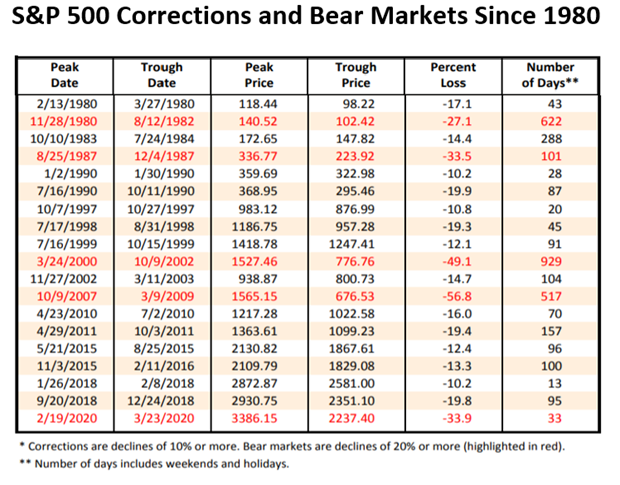

In the last 40 years or so, the average annual price decline from a peak to a trough in the S&P 500 exceeded 14%. One year in five, the drop has averaged at least twice that. It is worth reminding that these drops have always been temporary.

On two occasions (in 2000-02 and 2007-09), the Index actually halved. And it wasn’t too long ago that volatility in a single month, March 2020, was so extreme that it tripped the circuit-breakers on Wall Street and paused trading four times. These are all examples of the zigs and zags along the market’s chaotic upward trend.

If you can look past the zigs and zags, the trend tells us the truth—the S&P 500 entered 1980 at 106, and ended 2021 at 4,766. Investors who had the courage and discipline to stay the course in those 42 years were rewarded with an average annual compound rate of total return (with dividends reinvested) of more than 12%.

This underscores our shared belief that the essential challenge to successful long-term investing is neither intellectual nor financial, but temperamental: it’s how we react, or better yet, do not react to market declines. These shared principles will continue to be the foundation of my advice to you in the coming year and beyond.

Part Two: Current Observations

It would be counterproductive to look at the past year in isolation. It was the second act of a drama that began early in 2020, brought on by the largest global public health crisis in a hundred years.

The world elected to respond to the onset of the pandemic essentially by shutting down the global economy—placing it, if you will, in a kind of medically induced coma. The U.S. saw its fastest economic recession ever, and a one-third drop in the S&P 500 in 33 days.

Congress and the Federal Reserve responded with an unprecedented wave of fiscal and monetary stimulus. I know the word “unprecedented” has been thrown around a lot in the past two years, but this point cannot be overstressed: we are in the midst of a fiscal and particularly a monetary experiment which has no direct antecedents.

This renders all economic forecasting—and the investment policies made using them—hugely speculative. If there were ever a time to just put our heads down and work our investment and financial plan, ignoring the noise, this is surely it.

If 2020 was the year of the virus, 2021 was the year of the vaccines. Vaccination as well as acquired natural immunity are in the ascendancy, regardless of how many additional Greek-letter variants are discovered and trumpeted to the skies as the new apocalypse. This fact, it seems to me, is the key to a coherent view of 2022.

In general, it seems most likely that in the next year:

- The lethality of the virus continues to wane

- The world economy keeps reopening and corporate earnings keep advancing

- The Federal Reserve begins draining excess liquidity from the banking system, with some resultant increase in interest rates

- Inflation subsides somewhat

- Barring some other exogenous variable—which we can never really do—equity values continue to advance, though at something less (and probably a lot less) than the blazing pace at which they’ve been soaring since March 2020

These outcomes seem to me more likely than not, but this is not a forecast. I repeat: this is not a forecast! I’m fully prepared to be wrong on any or all of the above points—and if and when I am, my recommendations to you will be unaffected, since our investment strategy is driven by the plan we’ve made together, and not at all by current events.

Part Three: Lifeboat Drills

On a more personal note, I hope everyone is in good health and good spirits. These have undoubtedly been the two most shocking and terrifying years for investors since the ’08 Financial Crisis. First it was the outbreak of the pandemic. Next, it was a bitterly partisan election, then the pandemic’s second wave, and most recently a 40-year inflation spike.

You might not be human if you haven’t experienced volatility fatigue at any point in the last two years. I know I have. But as we learned in the earlier example spanning the last 40 years or so, volatility itself does not lose money—panic in the face of volatility loses money.

If history is to be any guide—and it’s the only rational guide I know—most years witness at least one period when the equity indexes drop 10-15%, known as a “correction.” Bear markets (drops of more than 20% from the peak) happen every four to five years or so.

We don’t know when they will happen, or where the bottom will be. But we know they are as natural as the rain in April and the leaves changing in autumn, and they will pass as suddenly and unexpectedly as they arrived.

Enclosed you will find your very own Bodnar Financial pencil … it’s time to sharpen that bad boy, find a piece of paper, and do what I like to call a Lifeboat Drill. It is simple math, but the drill does require you to actually do it.

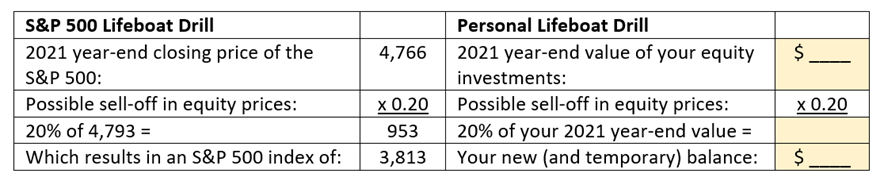

At the end of 2021, the S&P 500 closed at 4,766. Right now, a completely natural 20% sell-off would knock it down to 3,813. This would be considered a bear market:

The S&P drops 953 points to 3,813. Let’s say that out loud at least two times … the S&P drops 953 points to 3,813 … the S&P drops 953 points to 3,813 …

Now imagine for a moment the utter enthusiasm and excitement in the studios of CNBC and Bloomberg. The champagne and balloons will be out of view, but make no mistake, bad news is always good news for profiteers of panic.

Is this a market forecast? Far from it. But the next correction is never an “if,” it’s a “when.” And when the next one arrives, as the leaves will surely change in autumn, it is my hope that during that time you will do absolutely nothing. That you will fight the urge to follow the herd retreating into a cave of cash, tune out the news, and continue to act on the plan we made together.

Can you make ends meet with the resulting number of your Lifeboat math? Can you live with that temporary zig until it turns back into a zag? If we’ve been meeting once a year, your asset allocation should be appropriate for your age, cash flow, and liquidity needs. If it’s been longer than a year, call the office to schedule a review. Let’s make sure you’ve had your Lifeboat Drill.

Are you retiring soon? Let’s discuss your retirement strategy, and make sure you have enough cash available to meet your immediate needs.

We can’t predict, but we can plan.

As always, thank you for being our clients. All of us at Team Bodnar Financial wish you and your family a happy, healthy, and prosperous 2022.

For a printable version of this blog post and sources, click here.