Successful Investing = History + Discipline

As I write this, the masthead on the Wall Street Journal homepage switched. It features a topic other than Ukraine for the first time in weeks:

In my experience, the best time to revisit the facts of market history is when financial pundits start to share their opinions. And so I write to you, dear clients, with a quick update:

The S&P 500 closed today at 4357, a 8.58% decrease from the beginning of the year. We are still in correction territory as we were 3 weeks ago, and as we always knew we would be eventually.

Market corrections are completely normal events. The equities market drops 10-15% each year on average. We expect these drops to happen and in fact, we welcome them because they allow us to purchase shares at marked-down prices. Put another way: The best companies in the United States and the world are on sale right now.

We never know when corrections will happen, or where the bottom will be. These factors cannot be predicted no matter what the pundits shout from the studios of CNBC. And they will shout. There is a medley of fear for media outlets to choose from to get investors doom scrolling through their websites: Ukraine, inflation, rising interest rates, Covid-19, and China looming in the background of it all.

It is my job as your financial advisor to remind you that while extraordinary events are happening in the world today, the events of this market are not extraordinary in the slightest.

10% drops every year … 20% drops every five years … This is what markets do.

It’s easy to accept the concept of normal dips and drops in the market when times are good. How you respond when they happen, however, is what separates successful and failed investors. In my experience, successful investors act continuously on a plan. Failed ones react to current events.

As long-term investors we are given a choice: to be guided by the totality of the historical record, or today’s catastrophist headlines. I choose history.

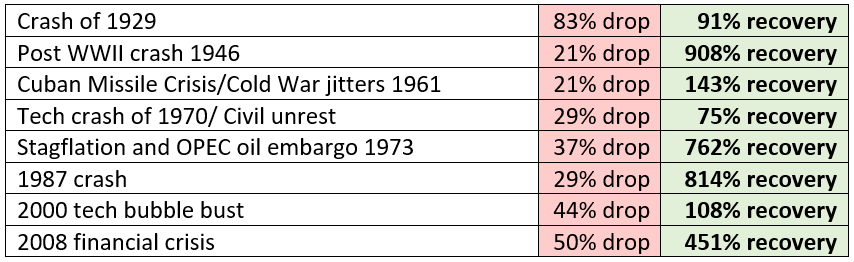

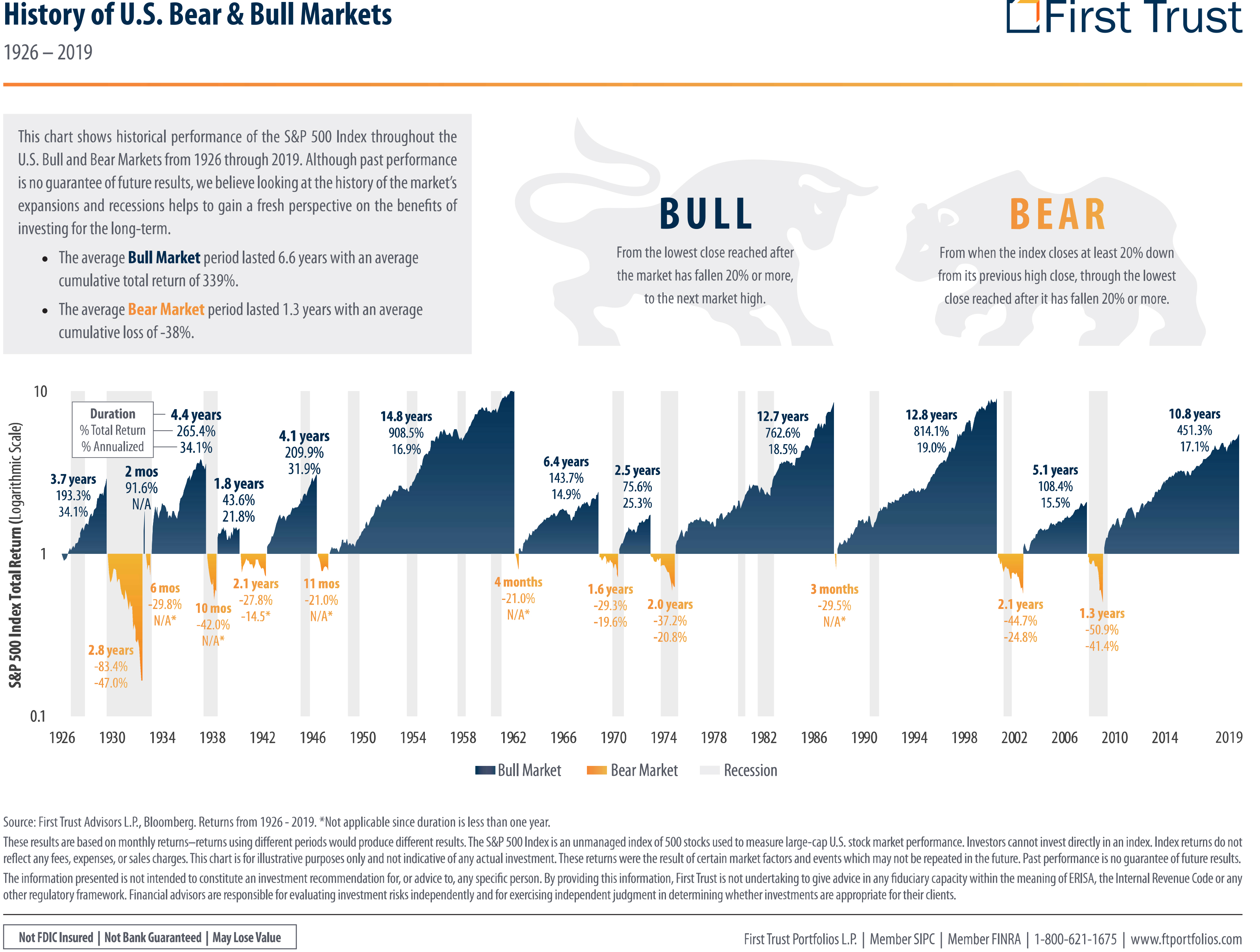

At the bottom of this post is a graph of all the U.S. bull and bear markets since 1926. The drops are infamous but have you seen the recoveries?

In every example, the comeback was far greater than the setback. That’s not financial punditry—that is historical record. Back to today…

On March 16, 2022, the Dow Jones Industrial Average closed at 34,063. Sure it’s down from the all-time high of 36,799. Could it get worse? Maybe. Could it reach 40,000 by year’s end? Absolutely.

We don’t know when it will happen. But as principled investors, we must believe that Dow 40,000 will happen eventually. We are faced with a choice: believe 100 years of historical data, or believe those on TV who insist “this time it’s different.”

This is what you pay me for. My job as your financial planner is to help you separate emotion from the calculus of being a focused, plan-driven, long-term investor. I am here to remind you all to take a break from the news, go outside, and don’t quit before the miracle recovery happens.

I am here to coach you through short-term volatility to protect you from long-term regret. The best way I can do that is to urge you to stay the course.

Stay the course. As always, I’m here to help.

For a printable version of this blog post, click here. And as promised, the graph: