2023 Annual Client Letter

In what has become somewhat of a tradition, allow us to be the last to wish you a very Happy New Year. January is a time for fresh starts and new beginnings, and coming out of the volatility of the 2022 markets we are pleased to write there is reason to be optimistic.

Without a doubt, the drama in the markets last year was just short of Shakespearean. The Federal Reserve was late to the game in bringing inflation under control, and when it finally entered the arena its efforts were aggressive, triggering a new bear market in equities.

Bond prices swooned in response to significantly higher interest rates, and the U.S. equity market sold off sharply. In the first half of 2022, the Standard and Poor’s (S&P) 500 fell 23.6% from its all-time high at 4,796 to a closing low of 3,666 on June 16.

It rose slightly before the end of that month, finishing its worst first half since 1970 at 3,785. At its most recent low in October 2022, the S&P 500 was down 27%. Financial pundits will refer to 2022 as a “negative year.” (Feeling optimistic yet? The good news is coming, I promise.)

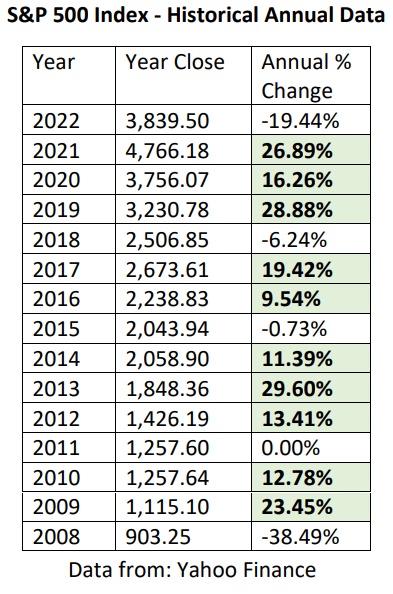

If we take a minute to look at the Big Picture, that same equity market has enjoyed 10 “positive” years since the low of the Financial Crisis. If you didn’t panic and sell during that time, your stock holdings on average are up by about 5X:

Up 5X from 2008. Feeling optimistic yet? Repeat the trend line mantra with me: the advances are permanent, the declines are temporary. The advances are permanent, the declines are temporary.

Even so, it never feels good to sit in a market trough. Even when you know declines are temporary, down markets are emotionally painful to live through. This is why we work together.

You would not be human if you did not feel fear when (as it’s done 13 times since 1946) you watch an average of a third of your equity investments seemingly melt away in a bear market, and no one can tell you where or how it will end. And it’s OK to feel that fear, as long as you don’t act on it.

It’s my job to give you perspective during down markets, to zoom out and look at the big picture together. And when we do that, there is plenty of reason to be optimistic.

Yes, we have been on a stock market rollercoaster since 2020. However, despite the volatility, the market managed to close out 2022 higher than it ended 2019 (3,839.50 versus 3,230.78; a gain of nearly 19%). Not historic, but not at all bad for three years during which planet Earth upended.

We had no playbook for the pandemic. From Wall Street to Washington, nobody had lived through anything like it because the last pandemic happened about a century ago. And yet, I repeat, stocks on average closed out last year 19% higher than they closed out 2019. We are UP from the start of the pandemic. That is the big picture.

This validates our core investment strategy at Bodnar Financial, which is and has always been: tune out the noise and keep working your long-term plan. I continue to recommend this in the strongest possible terms, especially as gossip surrounding a recession creeps into the financial news.

Rather than looking at forecasts and speculation, we prefer to examine history. History tells us that bad market years tend to be followed by good ones, especially after a midterm election year. Since 1950, there have been 18 midterms. In each instance, the S&P 500 was higher in the following year by 14.7% on average. Stocks also tend to perform well in divided government, and the most recent midterm election cycle balanced power in Washington once again.

If you need a third reason for optimism, I’ve got another one for you. If we look at years following negative S&P 500 outcomes, the S&P 500 had back-to-back negative years four times since 1930: Great Depression, World War II, the 1970s, and early 2000s. It doesn’t happen often.

Make no mistake, we are entering 2023 with inflation and an expected recession. Corporate profit growth is expected to be flat, and consumer spending growth is expected to slow. (In some cases, when recession is anticipated, investors start to feel pessimistic and the market starts pricing that in early, which could explain some of the volatility we felt last year. Maybe the market is a couple steps ahead of the economy—it wouldn’t be the first time.1)

The burning question of the hour seems to be if, and to what extent, the Federal Reserve, in all of its inflation-fighting zeal, might tip the economy into a recession, if it hasn’t already done so.

If only we had a crystal ball. This outcome is unknowable, and we can’t make rational investment policy out of an unknowable. That said, if an economic slowdown over a few calendar quarters is needed to stamp out inflation, so be it. Inflation is a cancer and it must be destroyed.

Come what may, in the economy and in the news headlines, let’s try to remember that these are big picture macroeconomic issues. And that, you and I, are not investing in the macroeconomy.

Our portfolios largely consist of the ownership of lastingly successful companies: businesses that take defensive action to endure hard times, and opportunistic action to take advantage of them.

The balance sheets of these companies are strong. And in times of political and economic worry, we can rest assured that corporate earnings continue to drive equity values, not events.

We closed out last year with an event called “Investing 101,” a one-hour intensive on the timeless investment principles that have guided Bodnar Financial Advisors since 1988. As we head into the new year, I highly recommend watching it as a refresher on our approach.2 I have also enclosed a copy of our general investing principles, which we are available to review together at any time.

As I always say—but can never say enough—thank you for being our clients. It is our privilege to serve you.

For a printable version of this client letter, click here.

Footnotes:

1) Historically, the market tends to peak before the start of a recession and bottom before it’s over. Put another way, the stock market has usually recovered faster than the economy itself. Recessions and bear markets may occur simultaneously, but they should not be confused for one another.

2) You can watch it here: https://www.youtube.com/watch?v=chSa2mwgwCE