Give Thanks to Market Volatility

Dust off the extra folding chairs and get the family recipes out– Thanksgiving is coming! We will once again reflect with love on the people and things we take for granted during the year, among them our family, health, and friends.

We will also see difficult relatives. You know the ones… they make us laugh one week and drive us crazy the next. For the investor family, that relative is market volatility.

Volatility is a market force that gets no respect within the investor community. It makes portfolios rise and drop like a rollercoaster, sometimes within the course of a single day.

Rollercoasters aren’t for everyone– kind of like your weird uncle. But unlike Uncle Fred, the thrill ride of market volatility has been the largest wealth creator in the history of the world.

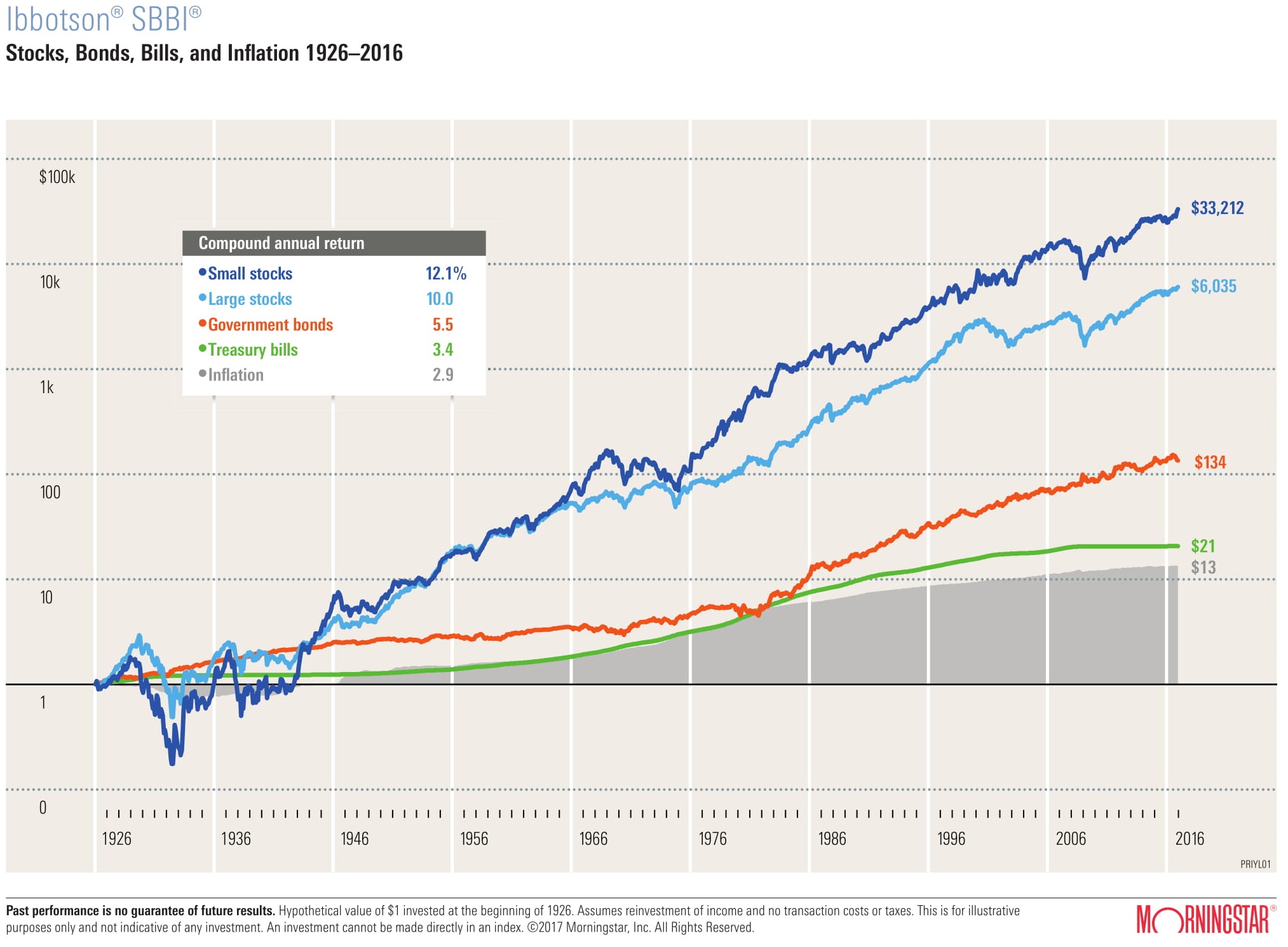

Since 1926, large company U.S. common stocks have delivered an average annual return of 10 percent. Compare that to your checking account’s interest rate of 0.03 percent and you will quickly find yourself pledging allegiance to the Ibbotson chart.

I’ve included a picture of the chart for your viewing pleasure. As you can see, the lines trend upward but not smoothly. See those zigs and zags? That’s volatility–it makes investments go down temporarily, and up permanently. It allows families to increase and protect their purchasing power across multiple generations.

Those occasional 20 percent sell-offs were the “zigs” that allowed the Dow Jones industrial average to “zag” from 10,828 to 27,306 in the last 20 years alone. You couldn’t get these returns without the roller-coaster ride. Thank goodness for volatility.

When most people think of volatility, they see risk. These two words are not the same. The closing value of the stock market 20 years from now is unknowable, but judging by the data in the previous paragraph, I have a feeling it will be higher than today.

Next time someone asks you to invest in a low volatility fund, replace the word “volatility” with “return.” Does it sound safer now? I didn’t think so.

Successful long-term investors understand the routine of volatility. The market is like an ocean–it follows a natural life cycle of high and low tides. Investors ride the waves of a high tide, but they know a 10 percent correction will happen each year. They also expect a “low tide” 20-30 percent correction every five to six years, on average.

Fretting over these temporary corrections would be like getting upset the waves are crashing closer to your beach chair than they were six hours ago. Based on historical trends, what did you expect?

In fact, investors should rejoice in gratitude for the opportunities a correction presents. It’s a funny thing… when stock prices are low, investors bemoan a bad market. When clothing prices are low, it’s called a sale and customers love it.

Next time someone asks you if a low market is bad, ask them right back: Bad for whom? The buyer or the seller?

Let us all thank volatility for giving us a reason to resist timing the market. For giving us a vehicle to make up for lost time during our precious years leading up to retirement. For the chance to leave our children and grandchildren a nest egg that grows faster than inflation.

Rollercoasters can be pretty great, if you have the stomach for them.