Insights on Coronavirus and the Markets

We don’t normally share our blast emails to clients and friends of Bodnar Financial on the blog, but coronavirus fears are not going away anytime soon. For a dose of calm and common sense, keep revisiting this post for regular updates from NJ financial planner John Bodnar, CFP®, CIMA®.

Friday, May 1, 2020

Are We in a Bull Market or Bear Market? Take Your Pick!

Mr. Market: “Honey, where did you put the Dramamine?”

Mrs. Market: “I’m sorry Dear, we’re out. It’s been a rough 70 days.”

Longtime readers will note a recurring theme of my writing is the forward-looking nature of the equity markets, specifically their history of turning positive long before recessions end.

For the record, I am not blowing the ALL-CLEAR WHISTLE. How low the stock market ultimately goes in response to the current economic self-induced coma is unknowable, and truth-be-told, irrelevant. However, it is impossible for one with a mouth as big as mine to let the past month pass without a great big WOW!

♫ What a difference a month makes. ♫ Go ahead, whistle or hum the famous song… you know the tune. ♫ What a difference a day makes ♫ … a little tap dance is OK too.

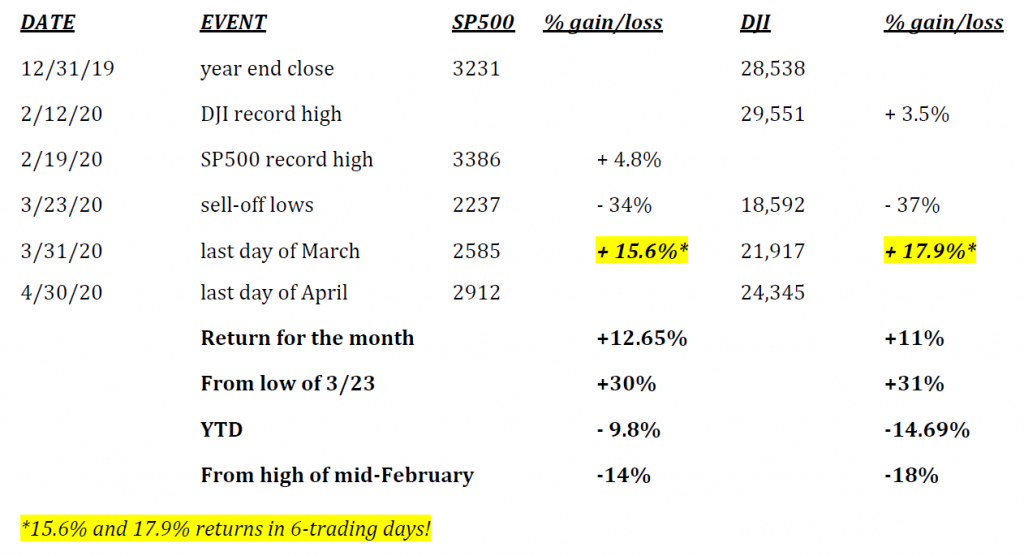

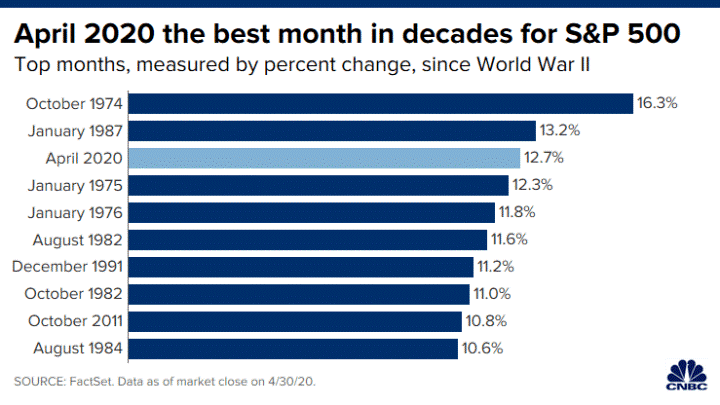

Bodnar Financial opened its doors in January 1988. The month of April 2020 set history as the highest total return for U.S. domestic stocks since our doors opened 32 years ago. Amazing. Here is why it is so darn hard to time your entries and exits from the capital markets:

So, are we in a bull market or a bear market? The major indexes are up 30% from the low of 38 days ago. It’s hard to imagine a 30% advance not moving the needle toward a BULL diagnosis. But we are still down for the year, and down 14% and 18% from the all-time highs. Could we retest the lows of March 23? Anything is possible.

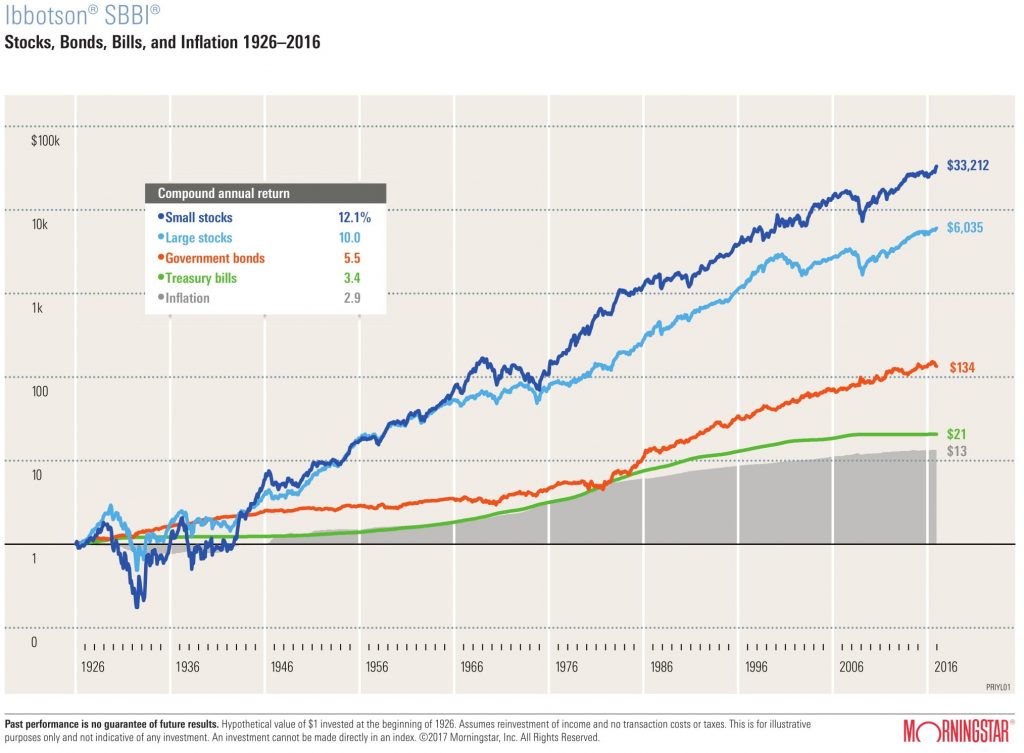

This chart is proof the past month was the best month since I opened the doors in 1988. You need to go back to January 1987 to find a month better than April 2020.

Unlike our seasick neighbors, Mr. & Mrs. Market, we shall take a pass on the Dramamine to steady our hand during the ups and downs of market cycles and rely instead on the lesson of history. Repeat the mantra: optimism is the only realism.

So, my comrades, on this May Day 2020, I close with not one—but three—Warren Buffett gems:

“If you look at what was here in 1776 and you look at what’s here now, this country has done an incredible job in terms of the deployment of resources and human ingenuity. The idea of people unleashing their potential … it’s absolutely a miracle.”

“Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”

“The factories don’t disappear, the farmland doesn’t disappear, the skills of the people don’t disappear.”

Be safe, wash your hands, and don’t believe everything you read on Facebook.

For a printable version of this update, click here.

Wednesday, April 22, 2020

“Adhere to your purpose and you will soon feel as well as you ever did. On the contrary, if you falter and give up, you will lose the power of keeping any resolution, and will regret it all your life.”

– Abraham Lincoln, “Letter to Quintin Campbell” (June 28, 1862)

My inbox has more than a few inquiries—I’ve not forgotten you—that resemble this: “John, hope you and your family and Team Bodnar are safe. (We are, thankfully.) Wow, some sell-off, huh? (Yes, it was the quickest 30% sell-off ever. I love living through history, don’t you?) Should I change anything? (No, unless your goals and objectives have changed.) Because I am sure you agree, this time really is different. Right?”

The History Lesson

With each tick of the clock, the economic damage caused by the coronavirus and the resulting shutdowns grows larger. It is not just businesses, small and large, feeling the pain. Educational institutions, hospitals, churches, nonprofits, and state and local governments are all finding it hard to remain financially viable.

Nationwide, our leaders have turned off broad swaths of the private sector—the ultimate and only source of income and wealth creation. Without the private sector, there is no money to pay for government, and no money to pay for schools, health care, or charitable organizations. To make up for it, the political class has resorted to an open-ended expansion of the Federal Reserve’s balance sheet (and expanded their power), and government borrowing and spending increases the likes of which our country has never seen outside of wartime. And who knows, we might break the wartime record before this is over.

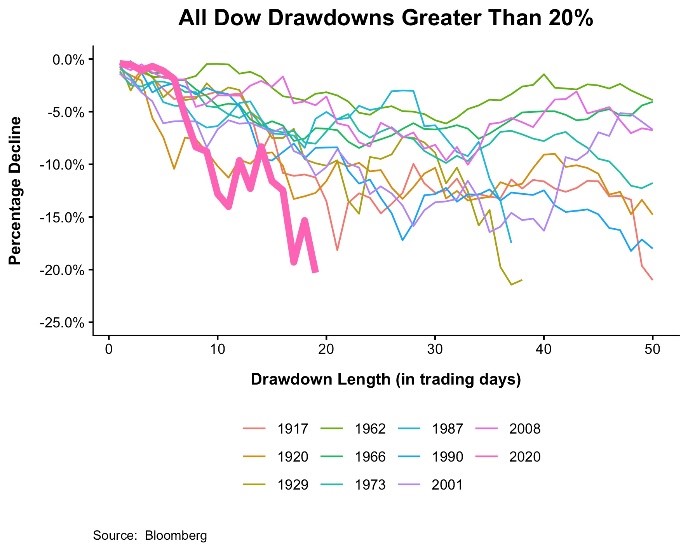

Am I finally agreeing it is “different this time?” Is there an investor alive today who can give testimony that he or she has witnessed an economy put itself into a self-imposed economic coma? I would say that is different. Or can anyone attest they have observed the broad market indexes traveling from a record high (Feb. 19) to a 30% sell-off in just 16 trading days?

If that is your criteria for “it’s different this time,” then you win. It is different this time. However, successful goal-oriented long-term investors do not use a criterion so narrow.

When you hear me quote legendary investor Sir John Templeton saying, “The four most dangerous words in investing are: it’s different this time,” Sir John was paraphrasing an older statement from the famous stock market operator, Jesse Livermore:

“I learned early that there is nothing new in Wall Street. There cannot be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again. I’ve never forgotten that.” – Jesse Livermore

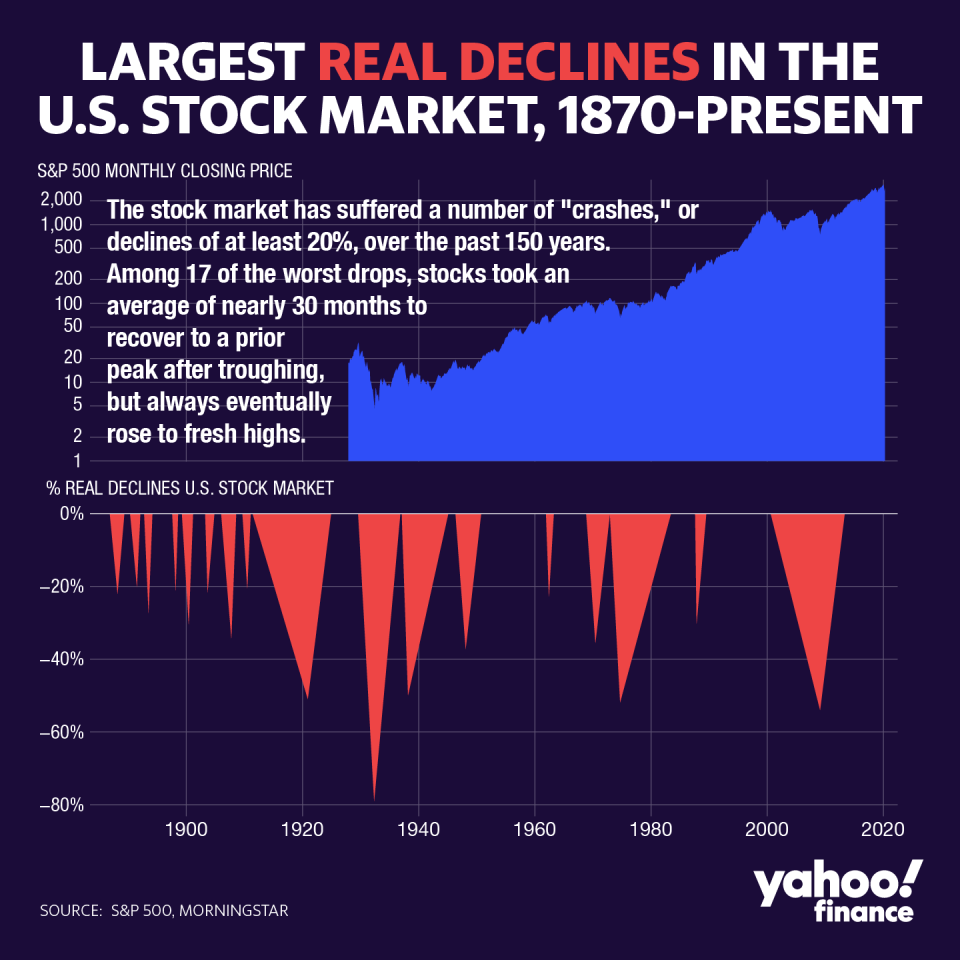

There have been 17 bear markets (stock market sell-offs of 20% or more) since 1870. If you study the history of those sell-offs, you will learn that each felt like a seminal event at the time.

- The stock market dropped over 50% during the Financial Crisis, and the facts leading to the sell-off were indeed unique. Can anyone argue that point?

- September 11, 2001. Need I say more?

- October 19, 1987. Black Monday. Down 23% in one day. One day!

We can continue through the entire list of 17, but my point is that while each sell-off is “different,” the aftermath is the same. When Jesse Livermore said, “there is nothing new…has happened before and will happen again,” what he meant was the story remains the same, just the staging changes.

Capital markets do not sell off 30% impulsively. When the crisis appears on its regular orbit of approximately every nine years (17 bear markets since 1870, do the math), each appears to those living through them to be unprecedented and unlike anything God’s green earth would ever experience again. Just as coronavirus feels like to us.

But like the cinematic masterpiece, Groundhog Day, the story of successful investing remains the same (just without the Sonny & Cher music). Crisis begins. Crisis grows. Panic ensues. Markets sell off. The Great Unknown(s) of the crisis begin to be eliminated. Crisis peaks, and ultimately—like every single one before it—crisis gets resolved. The economy begins to grow again, stocks resume their long-term trend upward and YOU, the patient, disciplined long-term investor, has once again been rewarded for standing herewith astride history.

On Current Events

As in 2008, many are worried that huge increases in quantitative easing and money growth, along with the purchasing of debt directly from the market, will lead to much higher inflation. To my comrades in the anarchy wing of Bodnar Financial, I too worry.

But, for today, that does not seem to be a problem. The consumer price index (CPI) fell 0.4% in March and is up only 1.5% from a year ago. On Tuesday (April 21), West Texas Intermediate (WTI) oil was trading at $11 per barrel, the lowest since the late 1990s, and 64% lower than its March average of $30.45. This suggests another negative number for the CPI in April. (More on oil later.)

But the drop in measured consumer prices in March was not just driven by lower energy prices. Other factors included lower prices for hotels, airline fares, and clothing. What do all these categories have in common? A massive drop in customers due to the shutdown.

Sure, hotels are cheap today, but almost no one is using them. Hotel occupancy rates are down about 70% from a year ago. Sure, anyone who flies can get cheap seats, but the number of people going through TSA checkpoints is down 96% from a year ago. (Not a typo. 96%!) Clothing prices fell 2% in March, as sales at clothing and accessory stores fell 50%. Who had time to buy clothes when you had to stock up on groceries and toilet paper?!?

Normally, I am not a fan of enhanced unemployment benefits. But the severe economic contraction brought on by the coronavirus and the government-mandated shutdown of businesses meant to stop the disease is a completely different animal from a normal recession. It is not just that people are staying away from economic activities because of the virus—the government is requiring businesses to shut down, magnifying job losses across the country.

Initial jobless claims averaged 216,000 per week in the four weeks ending on March 7, before the shutdowns. That is a total of 863,000, which was exceptionally low by historical standards (especially relative to the size of the labor force). In the four weeks since, about 17.1 million workers have filed claims, blowing away previous records.

Many of these layoffs were the direct result of the government forcing businesses to shut their doors. When people are deprived of their livelihoods by government fiat, it resembles a “taking” under the Fifth Amendment of the U.S. Constitution. In this unique situation, unemployment compensation resembles a “just compensation” for that taking. Unusual times to say the least.

Interest rates will go up eventually, but do not expect a sharp rebound. After the Great Recession, the Fed did not raise short-term rates again until late 2015, when unemployment hit 5%. After the expected job losses over the next couple of months, it will be a long time before we get back to 5% unemployment. Meanwhile, having witnessed two big recessions in a row, investors will place a larger premium on safety and risk aversion than they have for the past decade, which will hold the 10-year yield down relative to the economic fundamentals we’ll see in the eventual recovery.

What is different this time? We have never seen an economic shutdown that was self-imposed. The ability of people and governments to panic into giving up fundamental rights changes nearly every economic calculation. How do economists model risk in the future?

A Quick Comment on the Latest Headline: OIL

For those of you alarmed by the headlines, “Oil plunges below zero,” do not be. It is a temporary phenomenon brought on by the collapse of oil demand due to the global economy being put on life support. As the chart below shows, it is only the front-month oil contract (yellow) that has plunged. The contract that comes due December 2020 (white) has actually been rallying since its March 18 low.

The problem is a lack of storage. Oil traders and speculators, whom were long the front contract, had to get out of their position (i.e., sell) since they have nowhere to store the oil that will be delivered to them per the terms of the about-to-expire contract. So, they had to pay for storage. The price of oil per future contracts has remained relatively stable, averaging about $30 per barrel.

A Few Personal Comments

The key right now is to save lives, then to begin safely scaling back the lockdown to return to some semblance of normal life as soon as possible. At this point, that still seems weeks away. Our only defense is to avoid getting the disease, and that is why we are all hunkered down and wearing masks whenever we go out. During previous flu epidemics, 9/11, World War I and II, we were able to go about our daily lives in a reasonably normal way. We were never confined to our homes.

Some believe when the crisis ends, everything will quickly return to what life was like in January, but there will be lingering effects. Byron Wien from Blackrock put it right. He thinks the recovery will look like a square root sign, a “V” at the beginning, and then a gradual recovery.

Our office is open, but only Danielle (our newest employee) is physically on-site. The rest of us have been working remotely for a month and have no idea when our lives will return to normal. I think what all of us can be sure of is that some aspects of our lives will undergo profound change.

Here are a few ideas, in no particular order:

- Jobs and income for many will be impacted negatively by the lockdown. Even those of us still drawing paychecks will want to have more of a savings cushion and more cash on hand. We are also likely to keep more food in the house.

- Vacation plans are likely to be, at least for a while, less venturesome. Little foreign travel, more time at destinations we can drive to and get home from without worrying about flight disruptions and crowded airports.

- Get ready for hospital and medical center capital campaigns.

- Hospitals will need to stockpile more personal protective equipment.

- Almost all our generic drugs are produced abroad. Production of these drugs and thousands of other component parts and finished goods will be brought back home, particularly technology products.

- Expect a change in government attitudes toward pharmaceutical companies. Expect to hear less inflamed rhetoric against the drug industry in this presidential campaign and beyond.

- With unemployment reaching historic numbers, issues like climate change, inequality, and immigration may not be addressed for a while. The media is totally focused on medical and economic issues.

- Globalization is in the hot seat. Manufacturing has been outsourced to the lowest-cost producers wherever they might be located, keeping inflation low. Low oil prices should keep inflation in check for a while.

- Remote learning using the internet was underutilized to educate more people at a lower cost. The cost of private college has risen 20 times in the last half-century. Expect changes.

- Companies are learning that face-to-face contact, while desirable, is not always necessary. This should result in more virtual meetings and less travel, saving time and money. There is, however, no real substitute for a physical meeting with a client.

- Globalization created a world that was interdependent with an increasingly free flow of ideas and commerce. And that was good for everyone. The train has left the station for more authoritarian regimes that rule by edit. Stay tuned.

- In 2019, China accounted for one-third of world growth. The first and second largest economies in the world, the U.S. and China, must find a way to work together in the future.

As we look ahead, life will be different and for a time more subdued. We have been forced to think about the importance of friends and family, and to put material things in perspective. As Honest Abe wrote in his letter to Quintin Campbell: adhere to your purpose and you will feel better. ?

Be safe, wash your hands, and do not believe everything you read on Facebook.

For a printable version of this update, click here.

Thursday, April 2, 2020

If you are like me, you have been consuming so much news over the past couple of weeks, it is becoming information OVERLOAD. For that reason, I am keeping this update short and sweet.

A few thoughts on the current situation. Where to begin?

If there is a single word to describe March 2020, it is “extreme.” In the span of a few weeks, we witnessed the fastest bear market in history. It included the steepest market drop in a single day since the 1987 stock market crash, but also the biggest one-day recovery since 2008. (It’s a valuable refresher course in market volatility—don’t try to time the market, just get in.)

The main driver of this extreme volatility is uncertainty. We are at a moment of maximum uncertainty. The pandemic has become the most significant public health crisis in a century since the 1918 flu. We are not sure when the outbreak will subside, and part of our response has been to put the economy into a medically-induced coma until it does.

We are applying massive monetary and fiscal stimulus to the economic collapse, which will probably be deep but relatively fleeting. The short-term outcomes are unknowable. Everything that follows is based upon the undeniable fact that nobody knows what the world will look like in the next few weeks. And the markets HATE that.

People hate it too—I know I do. The Dow and S&P 500 had their worst first-quarters in history, and spoiler alert: for those who check quarterly statements, they will be down. We may even see another sell-off before this whole thing is over. But we have to fight the fear. The hallmark of a long-term, goal-focused investment policy is the practice of rationality under uncertainty.

Volatility itself does not lose money. Panic in the face of volatility loses money.

The circumstances of COVID-19 are unique. But recessions—and their inevitable recoveries—are not. Those we have seen before, many times. We have lived through several terrifying “black swan” events in our lifetimes, including the Financial Crisis of 2008-09, the Sept. 11 terror attacks, Black Monday 1987, and more.

Each produced a moment of maximum uncertainty, followed by great economic expansion with unprecedented episodes of soaring equity values and dividends. Don’t forget: after the March 2009 low—down 57%!—the S&P 500 compounded at over 14% annually for nearly 11 years.

What happens over the next few weeks is unknown. We don’t know which way the equity market’s next 20% move will go. But we know with crystal clarity which way its next 100% move will be, and I encourage you not to risk missing it. And, if you have children or grandchildren, you should encourage them not to miss it either.

Be of good cheer. This too shall pass.

PS: My belief that optimism is the only true realism will never change, but even I like to check my own bias from time to time. It is worth noting, while some of my more pessimistic industry colleagues view current circumstances differently, we are arriving at the same conclusion right now. Howard Marks’ brilliant March 31 memo, which I recommend for those who haven’t reached pure information overload yet, ends as follows:

“You may or may not feel there’s still time to increase defensiveness ahead of potentially negative developments. But the most important thing is to be ready to respond to and take advantage of declines. The world will be back to normal someday, although today it seems unlikely to end up unchanged.”

Tuesday, March 17, 2020

“My center is giving way, my right is in retreat, situation excellent. I shall attack.”

– French General Ferdinand Foch, 1914 Battle of the Marne

History may not exactly repeat, but it does seem to rhyme. It’s a newly coined version of an old saying, and I like it and have taken to using it often.

Speaking of old…I’ve been in this business since 1981, which means I have experienced the 1987 crash, the end of the Dot-Com era, the September 11 terror attacks, and the 2008 Financial Crisis. I feel safe in saying that—while what we are witnessing today is unique to the subject matter—the characteristics and market reaction to the phenomenon seem eerily similar to those we have witnessed before.

So, here we are again: the tide is now running out fast and panic selling has swept over capital markets, arriving at what will be characterized as the fastest bear market in history.

What Happened? (for my engineers, analysts, and other statistics hounds)

So, the bull market that began on March 10, 2009, is officially over. It lasted 131 months (2,756 trading days, and one month short of 11 years in duration). It was the 11th and longest bull market since the end of WW2, producing the second largest overall gain.

S&P 500 Market Peak: 3386 (on Feb. 19, 2020)

That bull market was a beast. It gained +529% (total return) or an annualized gain of 18.3% per year (total return), and set 255 all-time closing highs.

Then, the market began to dip. The S&P 500 fell 29.52% to 2386 on March 16, 2020. The fall was the fourth drop of at least 15%, but was the first decline of at least 20% that has occurred during the bull market that began on March 10, 2009.

The other three “near-bears” ended on:

- July 2, 2010 (off 16%)

- 3, 2011 (off 19.4%)

- 24, 2018 (off 19.8%)

In the 75 years from 1945-2020, the S&P 500 had 12 declines of at least 20%, or about one every 6.25 years. The stock market suffered its 12th bear since 1945 last week.

In the previous 11 bear markets over the past 75 years, the stock market recovered 100% of the loss sustained, going above the previous bull market high. The average recovery time from the low point in the downturn to a new high closing price was 24 months.

This one may be hard to believe: long-dated Treasury bonds (like the Fidelity LT Treasury fund that Frontier owns in its portfolios) produced a gain of 46.4% on a trailing 1-year basis as of the close of trading last Monday. That is called diversification, and we practice it here at Bodnar Financial.

Why Does the Market React This Way?

(This section may be a little too much Inside Baseball for some of you, but fight through it.)

This is one of those periodic storms that upend markets every so often (i.e., 1974, 1987, 2008, etc.). Their path, duration, and resolution depend on the causes and the response by authorities—although they usually share similarities (the rhyme).

Since the Financial Crisis, investors have been volatility-phobic, regularly overestimating risk, leading to sharp, scary market declines in 2011, 2016, 2018. These sharp declines were in response to events that conjured up visions of 2008, none of which came to pass. Instead, what we got was the greatest bull market in history, proving another old saying during this past decade: Wall Street climbs a wall of worry.

At this early stage, this market decline is acting with a speed and depth that reminds me of 1987. Thus, the perceived economic risk is considerably greater than other declines. But the real risk is still unknown.

In broad terms, we have an exogenous event—the virus—that initially caused a moderate shock to global supply by disrupting the flow of goods from China. That has now morphed into a major disruption in global demand as the virus spreads around the world and governments attempt to curtail its spread and its effect on public health by closing schools, canceling all sorts of events, banning large gatherings of people, curtailing travel and so on. The impact could be large enough to knock the global economy into recession.

Now here is the really important part: markets are discounting mechanisms. They are engaged in real-time information processing, constantly adjusting to shifting expectations and new information to create an equilibrium between supply and demand. There is no clean picture of a market—economic models are built for the classroom, not the real world.

Markets are complex and constantly changing. Those changes can be abrupt, violent, and frightening. In the past, entrepreneurs built the fastest steamship, not only to move freight, but to deliver information about the wheat harvest in the Ukraine or the supply of tulip bulbs from Holland—they wanted to have an insider ability to profit in the capital markets.

The ability of millions of dollars to move with the click of a mouse based on a tweet has changed the landscape, but it’s still the same. Information has always been the lifeblood of capital markets. Sometimes good information, and sometimes disinformation.

Predictions on the full potential global reach of the virus have been very wide ranged, from relatively benign to catastrophic (i.e., 1918 flu pandemic). The economic outcomes have a similar spread, which the market MUST consider. That is part of why volatility is so high, it reflects the uncertainty and potential impact of that range of outcomes.

When the market thinks authorities don’t get it—like Trump’s speech last Wednesday—BOOM, new information and the market reflects that immediately with a dip.

When the market thinks proactive measures are being taken—like Trump’s remarks last Friday—BOOM, new information and the markets react with a 2,000-point DJI swing in the positive direction.

The market typically overreacts to bad news. Not always, but mostly, and especially when what the economists call the “left tail” contains really bad possible outcomes. There is a survival benefit to overestimating risk in evolutionary theory. Bodnar Financial veterans may recall a prior white paper on “why it is so hard for humans to be good investors.”

The NYC/New Jersey hospital system—one of the best in the world—might be slammed hard. Depending on the severity of symptoms, coronavirus patients need beds in all levels of patient care, from the ER to the ICU. The ability of hospitals to meet the sheer volume of patients is unknown. The process could look like a python swallowing a pig, or it could look like a python swallowing a whale. We don’t know yet. Thus, the market volatility.

What does all this economic jargon really mean? Stock markets must price in ALL the things that can or might happen. Not just what you and I think will happen, but what EVERYONE thinks might happen. And because many more things might happen than will happen, we get these crazy swings. But, as these possible outcomes narrow, the market’s accuracy greatly improves.

What Happens Next?

When markets crack like this, the bulls warn you against a failure of nerve (Buy!), the traders warn you against hesitation (Do something!), and the bears warn you against staying the course (Sell!).

My advice: Imagine the future.

Imagine how amazing the world will look in 20 years. Today we stand, not at the end of an era, but at the end of the beginning of the greatest technological explosion in history.

Honestly, you ain’t seen nothin’ yet. Today’s teenagers will live in a world of designer drugs built for their own personal genome. Surgeons will be printing 3D organs, and families will be keeping in touch with loved ones using a combination of virtual reality and hi-speed internet that produces a result we can only describe as a miracle.

Now, put down this paper and think about what the world looked like when you graduated high school (leaded fuel anyone?), or what the office looked like at your first job (typewriters?), or just 10 years ago (Pick you up at the airport? Just take an Uber, Dad).

Many of us have been highly critical of the government response to COVID-19 at both the national and state level. Some still are. But in the past week, the complacency narrative and the “It’s Just The Flu” narrative have disappeared from every politician’s vocabulary. In the past week, wheels of innovation and problem-solving began turning in private companies and associations that were not turning before. And it makes all the difference in the world.

Here comes the old Bodnar optimism, and I know you won’t believe me, but I tell you it is true: THIS WILL BE OUR FINEST HOUR.

As the coronavirus situation continues to play itself out, as have all the previous crises that precipitated the 11 prior bear markets since WW2, it remains impossible for me to predict when and how this problem will be resolved. Likewise, it is impossible to know when and how the markets will anticipate this resolution.

I can predict, however, the media will persist in reporting this as an unprecedented crisis in the economic and financial life of the world, and suggesting that it is Armageddon.

But none of that is my true purpose on this St. Patrick’s Day 2020. My purpose is to suggest—as difficult as it may be—to take our focus off the onslaught of catastrophist headlines, and put our focus where it belongs: on your goals (and those of your kids and grandkids), on the plan that you and I set out for the achievement of your goals, and on the portfolio we created together to fund your plan.

Because at the end of the day, I don’t run money. I run a financial planning practice that seeks to help clients achieve their life goals with a sense of security. You can look it up…it’s on the website!

Bodnar Financial (and by proxy, all of you) have elected to be guided by history as opposed to headlines. Rather than subscribe to the media’s revolving insistence that “it’s different this time,” we respond instead with “this too shall pass.”

You would not be human if you didn’t experience some degree of fear at the direction of current events. The great achievement, at times like this, is simply not to give in to the fear. In a very real sense, as I told a client on the phone today, my whole job is helping you toward that achievement.

A bear market is the acid test of how effective my work has been, and, the best way I know how to do that is by encouraging you to stay the course.

Thank you for being my clients. I’m always here if you need me.

Like General Foch, may we see in the adversity an opportunity. Use this time to fund your IRAs, 401ks, retirement plans, and 529 plans early. Increase your % contribution into your 401k, 403b, etc. for the next few months. Take advantage of the sale going on.

If you have cash that you have accumulated to take advantage of special situations….now would be that time. Take advantage of Warren Buffett’s investing axiom: “Be greedy when others are fearful.”

I know not the hour nor the day…but a stock rally is coming.

For a printable version of this update, click here.

Thursday, March 12, 2020

In the past few weeks, I’ve seen comparisons between the current stock market volatility and the Great Recession of 2008-2009. As I write this—at 5:00pm on Thursday, Mar. 12, 2020—I contend these similarities are overblown.

The Dow Jones Industrial Average is down 28% from its record high last month, about half the 53% drop witnessed during the 2009 Financial Crisis.

*Editor’s note: Feel free to take some deep breaths here before reading on.*

This is the moment we have been waiting for. We’ve enjoyed the longest running bull market in history, which started in March of 2009 and lasted for over 11 years. Coronavirus and oil price wars may have been the perfect excuses for this market correction—but it would have happened anyway, one way or another.

Why? Because this is what the stock market does. It makes portfolios rise and drop, sometimes within the course of a single day. The thrill ride of market volatility is not for everyone, but if you can stomach it, you will have the privilege of participating in the largest wealth creator in the history of the world.

At this point, veteran clients of Bodnar Financial can recite our unofficial office slogan by heart: “We don’t do Armageddon here.” Many of us surfed alongside each other on the waves of market panic during the Financial Crisis, and reminisce on those days like old war stories. If you are one of those people, you already know what this white paper is going to say.

But for those new to our office—welcome to the big show. This may be the first time you’ve read the phrase “bear market territory” in the news while having some skin in the game. That sinking feeling in your gut? That is market volatility. Your response to that feeling is what will separate the JV investors from the varsity.

We are not—I repeat—we are not—in Financial Crisis territory right now. That being said, we can learn an important lesson from what happened back in 2008-2009, and how the actions you take today will determine your success or failure as a long-term investor.

Let’s climb in the time machine and go back to 2007…

On Oct. 9, 2007, the Dow hit its high, closing at 14,164.

By March 5, 2009, it had dropped more than 50% to 6,594.

In the months between those dates, the media entered full-on hysteria.

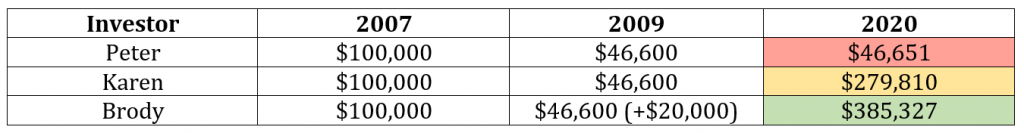

Three investors read the headlines in disbelief: Peter the Panic, Karen the Calm, and Brody the Brave. Each had stock portfolios valued at $100,000 when the Dow closed at the high in 2007.

When the market hit bottom in 2009, their portfolios had dropped to $46,600. It was not a great feeling. Here’s what they did.

- Peter freaked out and moved everything to cash. He took his $46,600 and ran to Wells Fargo to open a savings account.

- Karen stayed the course. She didn’t sell any stock, but she didn’t buy anything either.

- Brody doubled down. He had $20,000 in cash, and bought more shares in his portfolio. Stocks were on sale, and he was determined to take advantage of the discount.

What happened next was not as glamorous or exciting as the stock market drop itself. The economy slowly recovered, and the Dow began to climb upward once again. The recovery wasn’t a straight line—it was more like zigs and zags:

Years passed. The sun continued to rise and fall, and so did the stock market. In other words, life went on.

On Feb. 12, 2020, the Dow Jones enjoyed its highest closing on record at 29,551.

And when the media began writing stories on the 11th anniversary of the Financial Crisis, our three investors paused for a moment to reflect on where they landed up.

Peter had opened a savings account with an interest rate of .01%. He did not spend any of the money over the 11 years. In Feb. 2020, his savings had grown to only $46,651.

Karen did not touch a single investment. She made her normal nightcap a double, turned off the news, and held on until the storm passed. In Feb. 2020, her portfolio had grown to $279,810. She nearly tripled her money by taking no action at all.

Brody had invested an additional $20,000 into stocks at the 2009 market bottom. His friends gave him grief, but he didn’t care. When asked if a low market was bad, he responded with, “Bad for whom, the buyer or the seller?” In Feb. 2020, his portfolio had grown to $385,327. By investing an extra $20,000 and laughing in the face of fear, Brody beat Karen’s portfolio performance by over six figures.

We can run this experiment for any stock market correction, recession, and everything in between. The trends will always remain the same. History will continue to repeat itself. The stock market will continue to zig and zag on its clumsy upward climb, because as history shows us, that’s what the stock market does.

Like most things in life, investing is 10% what happens to you, and 90% how you respond to it.

Tonight, the Dow closed at 21,200.

So.

Which investor are you?

Monday, March 9, 2020

Today–March 9–is the eleventh anniversary of the crescendo of global panic that marked the bottom of the bear market of 2007-09. You can’t make this stuff up. It is to me a thing of the most wonderful irony that the world has elected to celebrate this iconic anniversary with–you guessed it–another epic global panic attack.

At this morning’s opening level of 2,764, the S&P 500 is down over 18% from its all-time high, recorded on February 19. Declines of that magnitude are fairly common occurrences–indeed the average annual drawdown from a peak to a trough since 1980 is close to 14%.* But such a decline in barely a month is noteworthy, not for its depth but for its suddenness.

As we all know by now, the precipitants of this decline have been (a) the outbreak of a new strain of virus, the extent of which can’t be predicted, (b) the economic impact of that outbreak, which is equally unknown, and (c) most recently, the onset of a price war in oil. (That last one is surely a problem for everyone involved in the production of oil, but it’s a boon to those of us who consume it.)

The common thread here is unknowability: we simply don’t know where, when or how these phenomena will play out. And in my experience, the thing in this world that markets hate and fear the most is uncertainty. We have no control over the uncertainty; we can and should have perfect control over how we respond to it.

Or, ideally, how we don’t respond. Because the LAST thing in the world that long-term, goal-focused investors like us should do when the whole world is selling is–you guessed it again–jump on the bandwagon and sell. Indeed, I welcome your inquiries around the issue of putting cash to work along in here.

On March 3, the erudite billionaire investor Howard Marks wrote, “It would be a lot to accept that the US business world–and the cash flows it will produce in the future–are worth 13% less today than they were on February 19.” How much truer this observation is a week later, when they’re down 18%.

Be of good cheer. This too shall pass. And please, wash your hands before you call me.

*JP Morgan Asset Management’s Guide to the Markets, page 13

Friday, February 28, 2020

“The Dow drops 4,400 points to 25,000. Say that two times out loud…. The Dow drops 4,400 points to 25,000… the Dow drops 4,400 points to 25,000. The financial pundits would have a field day predicting Armageddon. The market correction would eventually disappear, as mysteriously as it arrived. And it is my greatest hope that during that time—if this white paper has provided you any value at all, my dear reader—you would have done absolutely nothing.”

– Excerpt from a white paper written by yours truly on Feb. 7, 2020

We find ourselves at another Friday afternoon where I feel it may improve your weekend spirits to hear from your smiling financial planner. After returning with dividends some 46% in the 55 weeks through Valentine’s Day, the stock market was almost desperate for an excuse to correct. The coronavirus was (and remains) that excuse.

For those new to investing, welcome to the thrill ride of market volatility!

Volatility is a natural part of the stock market. It is also a cause of anxiety, but fighting through that anxiety is what separates the successful long-term investors from the jittery “market-timers” and .01%-return savings accounters who have tragically let fear prevent them from participating in the largest wealth creator in the history of the world.

Like all equity market panic attacks, this one will shine a light on those investors who are never going to make it. In this moment of media-induced hysteria, please remember this:

Temporary market drops are not losses. Drops only turn into losses if you sell.

Resist the urge to cash out all your money and bury it in the backyard. Quarantine yourself from the news, and take a page from the Warren Buffett playbook: make your normal nightcap a double, and HOLD ON.

This too shall pass. Optimism remains the only long-term realism.

Until next time,

John Bodnar, CFP®, CIMA®

P.S. from the Proud Poppa Department: My daughter and her husband are pondering whether to buy stock now, or wait until later for the market to drop even further. If you are sitting on cash, you might be wondering the same.

None of us have a crystal ball to predict the future, so I cannot provide an exact day the market will bottom out—but I do know my daughter is running in the right direction. Call the office if you are sitting on cash and want to discuss your investment options.

Friday, February 7, 2020

I have a theory that if three or more clients contact me on a single subject, it means ten times that amount are thinking about it, and the subject requires a response. Herewith is that response regarding Coronavirus.

Enjoy the attached Bodnar Financial White Paper. A little light reading for your Friday afternoon.