March Madness 2025: The Most Expensive College Tuitions on the Bracket

When it comes to college basketball, fans know to expect the unexpected—but when it comes to tuition, there should be no surprises. It pays to plan ahead.

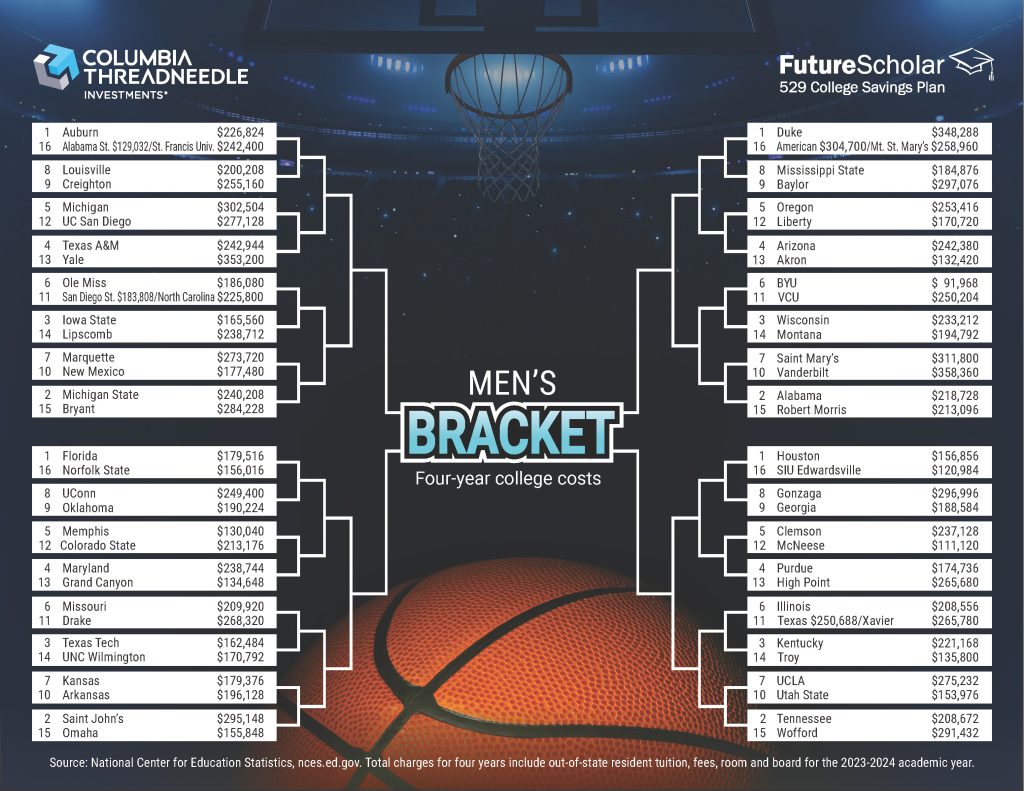

Each year, Columbia Threadneedle Investments puts together a College Cost Bracket. It lists the price of a degree from each school participating in the men’s March Madness tournament:

Six of the schools on this year’s bracket are over $300k!

Michigan: $302,504

Yale: $353,200

Duke: $348,288

American: $304,700

St. Mary’s: $311,800

Vanderbilt: $358,360

Four more colleges sneak in just under that line, with tuition totals in the $290ks (Saint John’s, Baylor, Gonzaga, and Wofford).

How am I supposed to pay for college?

One of the most powerful tools for college savings is a 529 plan for each child, which allows you to save money for education with no federal income tax on interest earned. And when the time comes to use it, you can make tax-free withdrawals on qualified expenses at eligible schools.

What can a 529 plan pay for?

Columbia Threadneedle also compiled a handy list of what a 529 savings plan can pay for (aka. “qualified expenses”) and where it can be used:

- In-state and out-of-state colleges

- Public and private schools

- Vocational schools

- Technical and trade schools

- Certain international educational institutions

- Any public, private, or religious elementary or secondary school (K–12)

- Apprenticeship programs that are registered and certified with the Department of Labor (DoL)

- Repayment of principal/interest on any qualified education loan up to a $10,000 lifetime limit for the designated beneficiary and/or sibling of the beneficiary

Qualified expenses

For postsecondary education:

- Tuition and fees

- Books, supplies, and equipment required for enrollment or attendance

- Room and board: On- or off-campus for students who are at least half-time

- Computer, peripheral equipment, software, and internet access if used primarily by the beneficiary

- Special needs services as required by beneficiaries in connection with enrollment or attendance

- Fees, books, supplies, and equipment required by a registered apprenticeship program

It can also pay tuition up to $10,000/year per student for K-12th grade. But remember — every dollar you spend before the college years is a dollar that’s not compounding interest year-over-year in your account. If you can, leave the money in your 529 plan and let it grow!

If you’re interested in opening a 529 plan, we can help. Call the office to learn more.

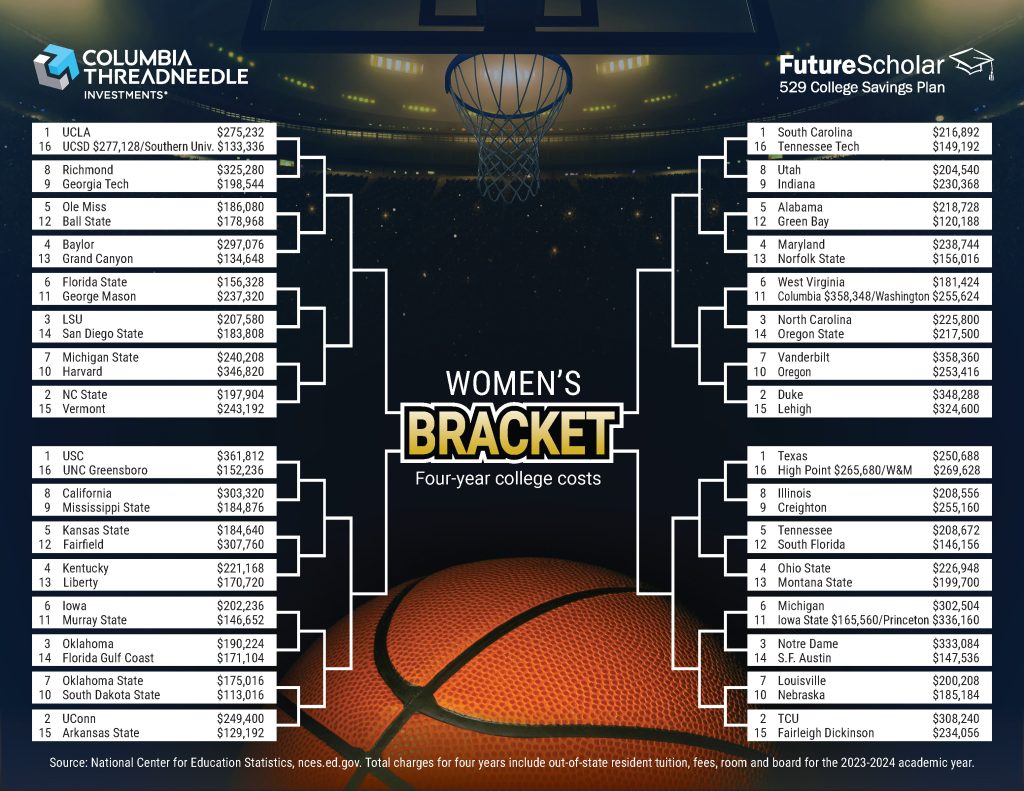

And for those interested in the women’s bracket college costs …

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.