Markets are down. Accounts are down. We’ve seen this movie before…

Sometime in the early 1960s, my best guess is that it was January 1965 when I was six, my parents allowed me to watch The Wizard of Oz. Back then, it was only available as a much-anticipated annual event each December or January on CBS.

My parents were grown-ups and had seen the movie before. Kid Johnny, of course, had no prior knowledge aside from everyone referring to it as the WONDERFUL Wizard of Oz.

So, when the Wicked Witch of the West hit the screen, I was all the way under the pillows on our family room sofa for much of the duration of the movie.

I was sure that terrible woman was going to kill that poor little girl and her dog, and she was going to kill me, my parents and all my goldfish. My parents kept telling me that it was only a movie, which just confirmed to me how fatally deluded they were.

The witch did not prevail. And each time I watched the movie since, I haven’t ducked under the sofa pillows. It’s not as scary anymore because I know the ending.

History doesn’t repeat itself scene-for-scene like a movie, but it does rhyme. And April 2022 will go down as the NASDAQ’s worst month since 2008. If you are the type of investor that opens your statements each month, let me prepare you: April is going to be ugly.

If you are a new investor, you may find yourself wanting to hide under the sofa pillows. But my message to you is this: Do not panic. We have seen this movie before.

The economic plot that plays repeatedly throughout our lives is like the plot of The Wizard of Oz. Those who have the courage to continue the journey win in the end. Optimism wins and pessimism loses.

There are some scenes where the good guys are riding high, others where doom appears near. Those scenes become less scary every time you live through the movie. If this is your first time experiencing the “market correction” scene, you have my permission to consider me deluded. But, like my parents, I have in fact seen this movie and here’s how it looks:

ACT 1: New equity market highs, supported by earnings or simply by speculation mania, and sometimes a combination of both. Everybody feels good in Act 1.

ACT 2: The onset of economic and financial weakness, company earnings and economic growth slow. This is part of the natural lifecycle of the market, but pundits react as if it’s a crisis. People begin selling more than buying, driving equity prices to significant lows. On average, that drop is about a third below the market peak as it has been 14 times since the end of World War 2, or every 5.4 years. Nobody feels good in Act 2 except Warren Buffett, who has seen the movie so many times that he gets excited tickets are two-thirds the price with popcorn included.

ACT 3: An economic recovery with earnings and dividends soaring, enough to propel equity prices to new all-time highs. As the credits roll, the screen says: The decline is always temporary, but only if you didn’t panic and sell.

Folks, the plot is always the same, only the staging changes.

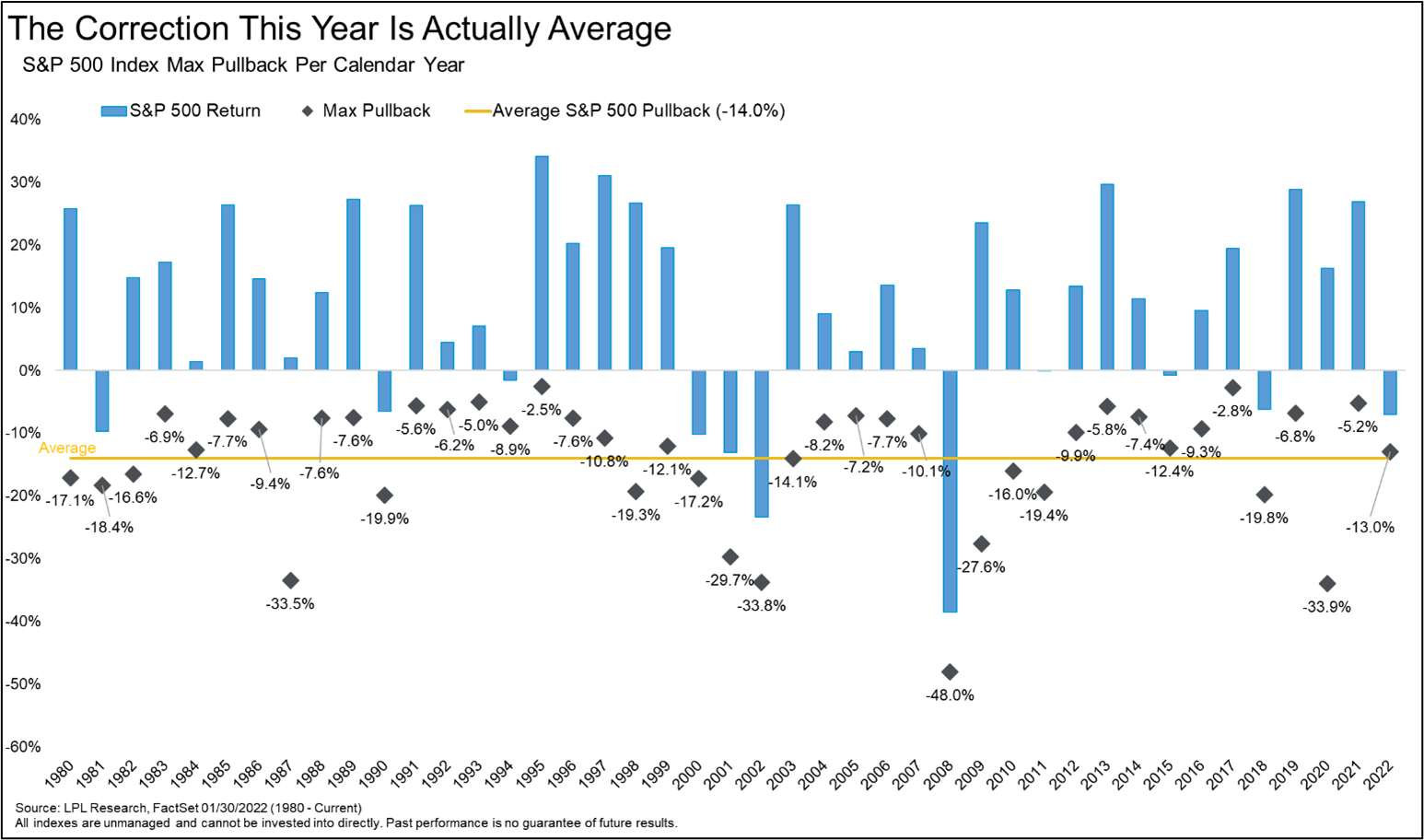

Note: The S&P 500 has corrected 13% this year. The average year since 1980 has corrected 14%. Of the 21 years the market pulled back since 1980, 12 of those years stocks came back and finished the year higher. By YEAR’S END. (Credit: Ryan Detrick, CMT)

This time around, Act 2 is a hysterical overreaction to a Fed tightening cycle. Central banks like our Federal Reserve periodically tighten the money supply when the economy overheats. This causes a slowdown in the economy—thereby slowing down inflation. They purposely attempt to destroy demand by raising interest rates.

Hard to believe, I know. But people go to movies to purposely be scared. Rising rates is how the Fed scares consumers, corporations, and investors into slowing down their personal spending so prices get back under control.

A very common theme during many Act 2s of the past 100 years has been rising interest rates, often resulting in a recession. A recession is a period when the national GDP contracts for two consecutive quarters. Will that happen again? It will eventually. It always does. It’s part of the normal business cycle.

Recessions, like bear markets, are one of the Wicked Witches of the West. They scare people sometimes, but you can’t have the movie without them.

Right now, we are in Act 2. It feels crummy because our Act 1 was spectacular. In the last three calendar years alone, the S&P 500 had 24% annual returns—in the middle of a pandemic. (You think the Fed may have overstimulated the economy a little too long?)

This, added to the general euphoria from 17.5% compound returns over the past 13 years since the lows of the Financial Crisis, it’s easy to start believing the market goes up every day. We fall so deeply in love with the scene, we forget about the rest of the movie.

But the Fed is finally starting to correct its overstimulation. Returns are slowing. More people are selling than buying. In fact, fair weather investors are fleeing equities in droves. In a single week (April 20), panicked investors sold nearly $20 billion from equity funds/ETFs. True to Act 2, equity prices are dropping to significant lows. In other words, the great companies of the United States and the world are on sale.

And there are plenty of prospective buyers. You won’t hear this good news on CNBC, but a wonderful milestone in the finances of the American household was achieved this year. With $2.5 trillion of “excess savings” on our collective balance sheet, the net debt of American households has collapsed to zero for the first time in 30 years.

That’s right: total household debt minus cash equals zero. Wow.

It has been a longstanding belief of this writer that the balance sheets of corporations and especially of households are in superb condition, but even I never anticipated this. That is a whole lot of dry powder piling up to fuel the next rally.

History tells us equity returns the winter after a midterm election have been above average, and this one has the making of a doozy. This is not a market prediction. As we all know, there are no facts about the future. But this does tell us that when the rally happens, people will be ready to buy and they are going to have the cash to do it. Thus, ACT 3 will begin once more.

My job as your financial planner is to remind you that I have seen this movie before over and over for the past 41 years. The witch does not prevail. I am here to help you fight through the normal anxiety that all investors feel during Act 2. To remind you to take no actions that you will regret when the sun rises over Act 3 (and it always does).

Here in the office, we are encouraging clients to fund their 2022 IRA, SEP, SINGLE-K, 529 college savings plans early, and looking for smart tax-loss swaps rather than waiting until year-end. When the market provides us with these opportunities, we must remain rational in the face of uncertainty and continue to work our plan.

Lions, and tigers, and bears… oh my!

For a printable version of this blog post, click here.