The Best Ways to Save for College (By Age)

College is expensive, and tuition prices are going up every year.

Your financial strategy will evolve depending on the ages of your children, and how many you have. But every stage in your plan will use a combination of these tactics:

- Applying for grants and scholarships

- Cashing in some investments or savings built up specifically for college

- Reducing standards of living (i.e., skip vacations, eat out less, etc.)

- Borrowing money

You should sit down with a financial advisor to determine what ratio of the options above works best with your current lifestyle. In the meantime, below are some general tips for making a college savings plan for children at any age.

Infants and Preschool

The minute you get your child’s Social Security number, you should open a college savings plan. Are relatives looking for a last-minute baby gift? Send them the link to Junior’s 529 plan!

Saving early allows you to take advantage of compound interest, the chance to earn “interest on your interest” over longer periods of time. It also gives you the opportunity to enjoy the returns of more volatile, growth-focused investments in a tax-free account.

Thanks to compound interest, smaller investments made early can have larger lifetime returns than bigger investments made later. Parents take advantage of this by “crowdsourcing” their college savings with family and friends looking for a creative gift idea. After all, does the baby really need another stuffed animal?

Some parents start saving even before a baby is born, to take full advantage of compound interest. With a 529 savings plan, parents can open a new account using their own Social Security number and switch the beneficiary to their child’s name after they are born.

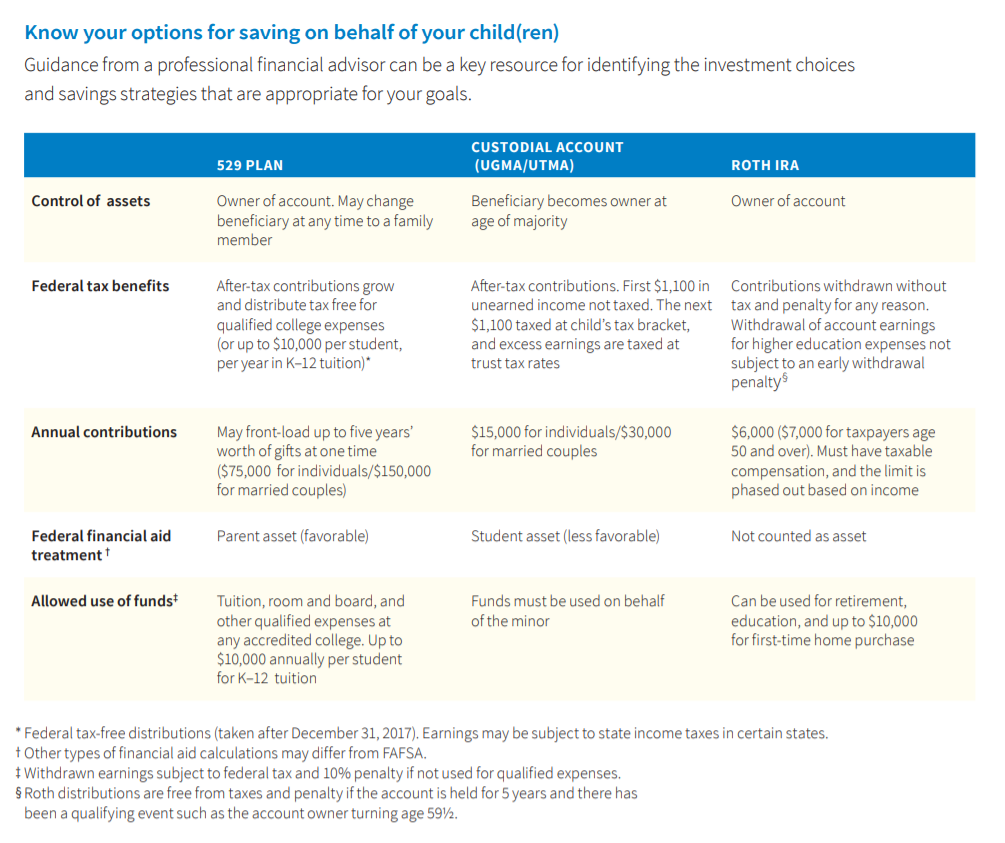

A 529 plan is not the only option for a college savings account, but it is my favorite (more on that below). Putnam Investments put together a useful table comparing the most popular investment and savings strategies for college:

Elementary and Middle School

It’s time to revisit your college strategy, especially if you’ve had multiple children in the past few years. You may have gotten a few pay raises, allowing you to increase your monthly 529 plan contributions.

Check to see if your plan – or financial advisor – can arrange for automatic contribution increases from year-to-year. If not, simply create a recurring calendar reminder to increase your contributions each year. Even if the increase is only $25-50/year per child, it will make a significant difference over time.

Remember, college funding will always require a combination of three things: cashing in investments and savings, reducing current standards of living, and borrowing money. How much of each depends on the family. The number of children you have doesn’t change the plan; it just changes the math.

Don’t overthink college contributions for multiple kids. Set up your 529 plans, automate your contributions, and let compounding do its work.

High School

For children entering high school, it’s a good idea to start filling out a FAFSA form. You don’t have to submit the form yet. Simply going through the practice of filling out the form will give you a sense of your family’s eligibility for government tuition assistance.

By the end of the process, the FAFSA will give you an “EFC,” or expected family contribution. That is the amount of money (based on your family’s metrics) that the federal government expects you to pay for a college education.

For example, if your EFC is $25,000 and your child wants to go to a school with $18,000 tuition, you won’t qualify for aid. If your EFC is smaller than the cost of tuition at your child’s college of choice, you will qualify for financial aid.

If your child has decided on a college, begin exploring prepaid tuition plans. You might be able to lock in current tuition rates, especially for in-state public colleges.

Juniors applying to college should research whether the schools require the College Scholarship Service Profile (CSS Profile) application as part of their financial aid process.

Parents of seniors must complete the FAFSA form as soon as possible after Oct. 1, and before June 30 at the latest.

If you are late to the game, do not panic and spend your retirement savings on college. College is temporary, but retirement is forever.

DO NOT turn off your 401(k) contribution at work to get more cash for college tuition. You can borrow money to put a kid through college, but you can’t borrow money for retirement. That would turn a problem into a crisis.

Beef up your 529 plan contributions, even if it feels like you are in the eleventh hour. Encourage family and friends to continue “crowdsourcing” your savings by making 529 contributions as birthday, holiday, and graduation gifts.

If your child ends up taking out student loans, it is STILL not too late to help. Learn from the past and take advantage of time to start investing for your future grandchildren.

You can help your children prevent a generational cycle of college debt by opening a “family legacy” 529 plan and making contributions starting today. A 529 plan can change owners and beneficiaries over the years, which means they can be passed on to kids and grandkids for generations.

There are no required minimum distributions (RMDs) on 529s like there are with retirement accounts. That money can sit there and grow until someone in the family needs it.

Did I Mention I Love 529 Plans?

A 529 plan could be a game-changer for your college savings strategy. If this is the first time you’ve heard of a 529 plan, below is a quick overview of the basics.

What is a 529 Plan?

A 529 plan is an opportunity for parents to save money for college in an investment account featuring federal tax-free growth and withdrawals. They are available to every single family, regardless of annual household income. There are a variety of 529 plans, and the rules (and tax benefits) for each plan vary by state.

529 Plans Aren’t Just for College

Thanks to the ‘Tax Cuts and Jobs Act’ of 2017, parents can now use 529 savings plans to pay tuition at elementary and secondary public, private, or religious schools. If you are planning to use a 529 plan for early education, you should consult your financial advisor to revise your long-term educational funding strategy.

Keep in mind, the biggest returns are a product of long-term investing. The longer you can keep the money in that investment account, the more time it has to take advantage of compound interest.

How Can I Spend 529 Plan Money?

529 plan withdrawals stay tax-free if the money is used on “qualified education expenses.” This usually includes tuition, fees, books, computers, and internet. It sometimes includes room and board, but you will need to verify that with your specific plan.

What Colleges Take 529 Plan Money?

529 account funds can be used at any college accredited by the U.S. Department of Education. This covers undergrad, graduate school, trade schools, and even some foreign colleges.

Who Can Open a 529 Plan?

Anyone with a Social Security number and a permanent address can open a 529 plan and name a beneficiary (aka. the future college student). Once the plan is open, anybody can contribute.

Who Controls the Money?

There are 2 main roles in a 529 account:

1) Account Owner: the person who opened the account. They decide when withdrawals are made. (Sometimes this person is called the “participant.”)

2) Beneficiary: the person who uses the money to pay for qualified education expenses. The beneficiary can change over time.

The account owner has legal ownership of the money in the 529 plan, NOT the beneficiary- even after the beneficiary turns 18 years of age. (Anyone who has ever met a teenager understands why this is a good idea….)

Who Can Make Contributions?

Everyone! Literally, anyone.

Where Can I Open a 529 Plan?

If you want to open a 529 plan, Bodnar Financial can help. Contact us today for a free consultation on your financial planning needs.

Disclaimer: Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses, summary prospectuses and 529 Product Program Description, which can be obtained from a financial professional and should be read carefully before investing. Depending on your state of residence, there may be an in-state plan that offers tax and other benefits which may include financial aid, scholarship funds, and protection from creditors.. Before investing in any state’s 529 plan, investors should consult a tax advisor. If withdrawals from 529 plans are used for purposes other than qualified education, the earnings will be subject to a 10% federal tax penalty in addition to federal and, if applicable, state income tax.