The Biggest Risk to Your Investments in 2020 is…

Happy anniversary!

…

Anniversary of what, you may ask?

…

Twelve years ago, today—October 13, 2008—was the best trading day for the S&P 500 in the last 70 years, and its fourth best gain ever. In a single trading day, the index saw a gain of +11.6%. It was almost enough to make investors forget we were in the middle of a global financial crisis.

The previous week was the Dow’s worst ever, which was the cherry on top of a steady decline that had lasted eight straight weeks. The end result of those two months was a 22% decline, something not seen since the ’30s.

Then, Monday, October 13, 2008, happened. In a single day, that drop was cut in half. And since that day, the index has more than tripled. It almost makes you feel bad for those who watched CNBC and sold their stocks in a panic the prior Friday:

S&P 500 closing values

Oct. 10, 2008: 899.22

Oct. 13, 2008: 1,003.35

Oct. 12, 2020: 3,534.22

The Friday sellers would probably tell you the Financial Crisis ruined their investment plan. But seasoned Bodnar Financial clients already know that isn’t true. Markets don’t lost money. People lose money.

Every successful long-term investor I’ve ever known acted continuously on a plan. They were students of history who embraced market volatility because they knew risk and volatility were not the same. Volatility is the daily zigs and zags of the market as it trends upward over the long term. Risk is a permanent loss of capital.

Who experienced a permanent loss of capital in this scenario? The investor that sold everything on October 10? Or the investor that did nothing, sweated out the volatility, and is now enjoying account values more than 400% higher in 2020 than they were in 2008?

Temporary market volatility is not the biggest risk to your investment portfolio. You are.

When human beings think they can outsmart the market, they lose. When their fear clouds the reality that short-term market declines are not permanent losses of capital, they lose.

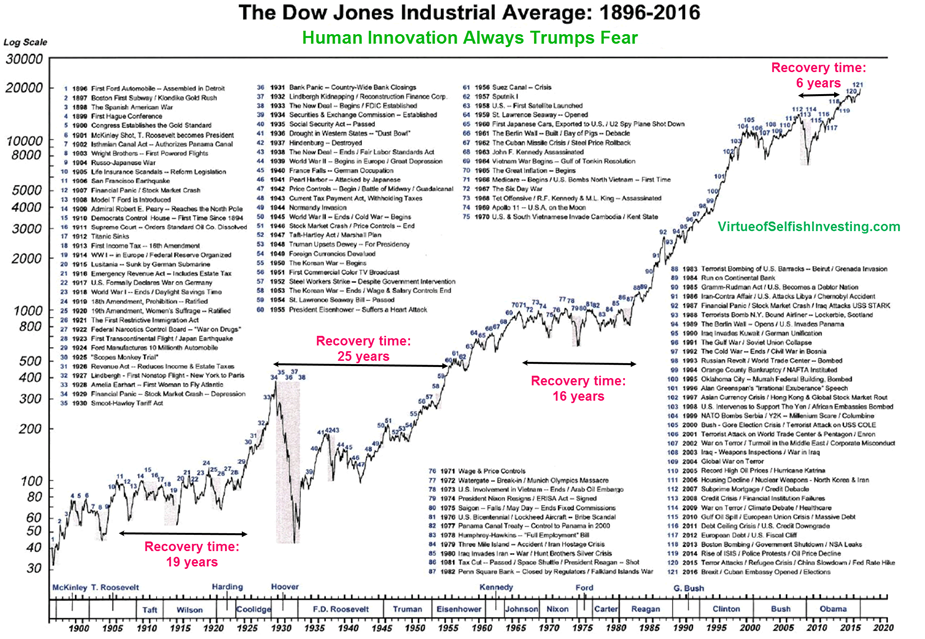

The S&P 500 has experienced at least 25 bear markets since 1928—about 12 of them have occurred in the last 50 years (can you believe 1970 was 50 years ago??). During that time, the United States lived through incredible trauma: terrorist attacks, oil embargoes, presidential assassinations, wars, pandemics, you name it. Yet each time, the market continued its slow and lumbering—but permanent—advancement.

We cannot predict the outcomes of the market on any given day. Nobody can. We can only control the inputs. Our job is to make a long-term financial plan and act on that plan, rather than reacting to the news.

You cannot make a financial plan based on “what-ifs.” For one thing, there are too many of them. I mean seriously, who had “pandemic” on their Bingo card for 2020?

Three years ago, the Federal Reserve forecasted the Fed funds interest rate would be 2.9% and the U.S. unemployment rate would be 4.2% in 2020. In reality, what are we seeing? Interest rates of 0% to 0.25% and 7.9% unemployment.

We just don’t know what the future holds. It’s okay if that feels a little scary. But you have to have faith the market will continue marching on. Don’t take my word for it—the past 100+ years of history says it is so:

Here is what we DO know, as students of history and champions of data:

- The market has historically come back before the economy.

- The market often rebounds as sharp and violently as it dropped. And we will never know exactly when this will happen, so we don’t try to time it.

- Short-term volatility is a small price to pay for permanent increases in capital.

- If you are waiting for the perfect time to invest in the COVID-19 recovery, you’ve already missed it.

But try not to overthink the calendar. After all, to paraphrase the ever-quotable Nick Murray, “the best time to buy stocks is when you have the money.”

For a printer-friendly version of this blog post, click here.