The No-Frills Guide to Paying off Student Loans

I hate to tell you this, but we should have been having this discussion while you were a sophomore in high school. However, recent college grads are still in a better position to pay off debt than any other generation, because time is on your side.

If you are losing sleep over student loan debt, you’re not alone. Americans owe over $1.4 trillion in student loan debt, spread out among about 44 million borrowers. The standard repayment plan for federal student loans is a 10-year plan, but the average bachelor’s degree holder takes 21 years (!!!) to pay off loans.

This doesn’t have to be you. Below is a no-frills guide for people who are motivated to pay off their student loans, once and for all.

Before we get started, there is one financial concept that drives almost every aspect of your repayment plan: compound interest.

What is Compound Interest?

This is the financial miracle that allows you to collect “interest on your interest” over time. In other words, putting away $100 a year for 10 years will have a much larger return than just having that $1000, 10 years from now. Depending on the account, interest can compound daily, monthly, or annually.

The Bottom Line: Compounding can be your best friend, or your worst enemy. When it comes to retirement savings, your balance can take on a life of its own. When it comes to debt, your amount owed can grow rapidly in the opposite direction. The main takeaway is: the earlier you can start investing money and paying down debt, the better.

The Details: Here is the general idea…

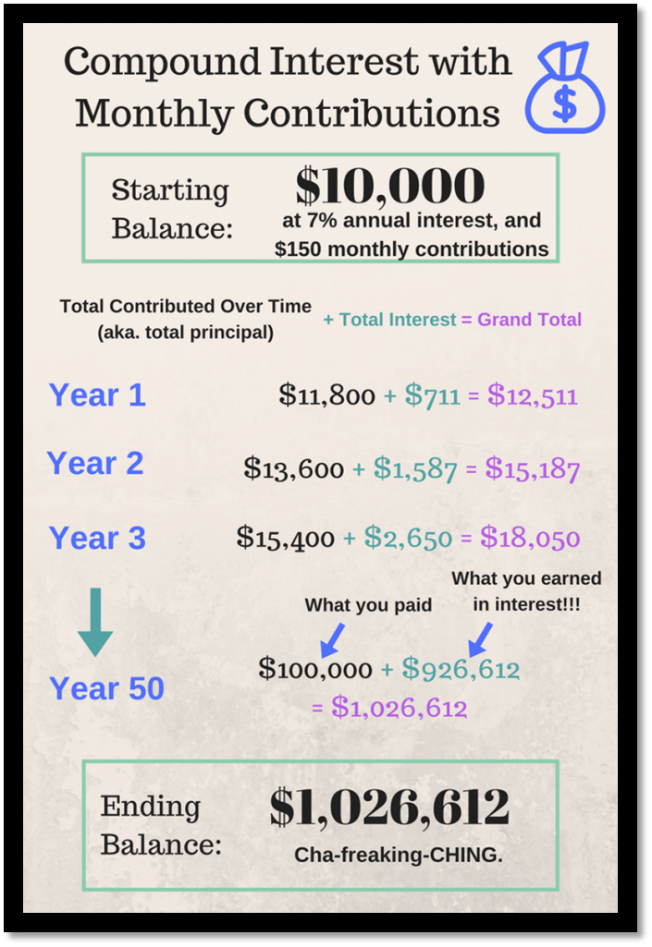

Let’s say hypothetically you have an investment account with $10,000. It has an average annual return of 7%. This means you can expect to earn around $700 (or 7% of $10,000) in interest if you leave your money alone for 1 year.

Now here’s where it gets good. If you keep your money in the account, you will earn around 7% interest each year on your original money, AND on the interest you’ve already earned. You will earn interest on your interest. That’s called “compounding.”

Look what happens if you deposited that original $10,000, and added another $150 each month for 50 years:

STEP 1: Figure out the basics of your loans

Where are your loans?

Student loan holders usually have no problem finding you, because they want your payments! However, you can access your loans within the National Student Loan Data System (www.nslds.ed.gov).

How much do you owe in principal?

“Principal” debt refers to the actual amount of debt you owe. The more you can pay off in principal, the less interest you will have to pay in the long run.

What are the interest rates on your loans?

When you access your student loans in the NSLDS, you may notice they have split into a bunch of different classes. Each of these loans will have its own interest rate. It’s important to note the difference when making your payment plan.

On your current payment schedule, how long will it take to pay them off?

Take that estimated date, and write it in your calendar. Knowing your exact “Independence Day” will help you stick to the plan.

Student Loan Hero has a ton of free calculators to help you get organized.

STEP 2: Make a list of every loan you owe

You should be making the minimum payments on all your loans, while tackling the principal balance of one loan at a time. Organization is key here.

Take a sheet of paper and make a list of every student debt you owe, the minimum payment amount, and the payment due date. Then set up auto-payments from a checking account, or at least write the dates down in your iCalendar as recurring events so you don’t miss them.

STEP 3: Start paying off the loan with the highest interest rate first

This strategy is called “The Avalanche Method,” and it allows you to pay the least amount of interest in the long run. While you are paying the minimum payments on all your loans, pay extra on the highest interest loan until it’s paid off. Then move onto the next highest, and so on…

There is an alternative payment strategy called “The Snowball Method,” which requires you to pay the loan with the lowest balance first. You end up paying more interest in the long run, but some people are motivated by those quick victories of seeing the smaller loans disappear.

Everybody has a different financial personality. Personally, I’d rather play the long game and pay less interest overall. But do whatever keeps you motivated!

STEP 4: Pay more than the minimum payment

Lenders don’t offer minimum payments as a courtesy. The more principal debt you can pay off with each payment, the less interest you pay in the long run.

STEP 5: Make all the minimum payments on time

If you miss the minimum payment due dates, it will hurt your credit score. You need a strong credit score to buy a house, get a job, or even refinance/consolidate your loans down the road. Don’t fall victim to this unforced error. Set a recurring calendar reminder to make your payments early and often.

STEP 6: Consider loan refinancing or consolidation

Refinancing and consolidation are not the same thing. Loan refinancing is a way to lower your interest rate and save money on the total cost of your loans. The better your credit score, the better deal you will get.

Federal consolidation simplifies your payments by combining all your federal loans under a single servicer of your choice. Your new interest rate is the average of all the individual rates, rounded up to the nearest 0.125 percentage point. There are positives and negatives to this, depending on what type of loans you have.

Be careful: refinancing means forfeiting eligibility for loan forgiveness and income-driven repayment. If those are part of your repayment strategy, do NOT refinance or consolidate your loans. It’s also important to understand that refinancing and consolidating are not reversible. If you decide it was a mistake, there is no going back!

STEP 7: Use cash windfalls to pay loans

If you get a big tax refund, graduation money, birthday money, or a family inheritance: throw that lump sum towards the principal on your loans. Do not spend it!

STEP 8: Sign up for auto payments

Some lenders offer interest deductions for people who enroll in auto-payments. This means you could pay .25%-.5% less interest by simply agreeing to auto-pay. Pay less interest, and protect your credit score by never missing a payment. Why the heck not?

STEP 9: Pay every two weeks, rather than monthly

Instead of paying monthly, split your monthly payment in half and pay that amount every 2 weeks. This is a little trick to sneak an extra full payment in every year.

How? We tell ourselves there are 4 weeks in a month, but that’s not technically true. There are always a few extra days each month, and they start to add up. Rather than 48 weeks a year (aka. 4 weeks x 12 months), there are actually 52 weeks in a year. Boom- extra payment. It’s a simple trick, but it could save you a significant amount of interest in the long run.

STEP 10: Use tax credits and deductions

While you are rushing to get your taxes done at the last minute, take advantage of the credits and deductions specific to higher education. The Student Loan Interest Deduction allows you to deduct up to $2,500 on federal taxes just for paying interest on your student loans. You can find the total amount of interest you paid on Form 1098-E, which your lender will mail to you around tax time.

The American Opportunity Tax Credit covers 100% of the first $2,000 in qualified expenses, then 25% of expenses after that up to $2,500. This includes tuition, fees, books and other “qualified education expenses.”

STEP 11: Get a job (and a side gig!)

Get some money in the door, even if it’s not the job you want. It’s always easier to get a job, when you have a job. Trust me- it’s just a rule of the universe.

Consider babysitting, focus groups, Etsy stores, Uber driving, life-guarding, Geek Squad, freelance writing, web development, or even renting your apartment on Airbnb when you’re out of town. You’re Millennials, which means you practically invented the gig economy. Be creative.

Side note for the self-employed: If you’re working a freelance side gig, don’t forget to put at least 20% of that money aside for tax season. This percentage will vary depending on what state and/or city you live in, and their tax rates. I recommend setting up a bank account just for self-employed tax money, that way you can pretend it’s not even there until April 15 when you need it. As that side gig grows, you may end up using that separate tax holding account to make “estimated quarterly tax payments.” (If you own a growing freelance business and have never heard of that term, look it up! Skipping estimated quarterlies could mean you owe the IRS big time penalties.)

STEP 12: Don’t forget to save for retirement

Some people are so preoccupied with paying off student loans, they forget to start saving for retirement.

I know, I know. This is the part where recent college grads laugh in my face and remind me they’re broke. But remember compound interest? Take advantage of it while time is on your side.

Start with small goals, so you don’t get overwhelmed. Make sure you are maxing out the employer match on your 401k. Slowly start building up six months’ worth of living expenses in an emergency savings fund. If you don’t have an employer retirement plan, consider opening an individual retirement account (IRA) and start maxing out your contributions as soon as possible.

You can do this.

The sooner you pay off student loans, the sooner you can start building towards your life goals. Don’t bury your head in the sand because it’s overwhelming. Get started today while time is on your side.