The Worst Year for Stocks in a Decade? Really?

According to CNBC, stocks are on track for the worst year in a decade.

If you couldn’t tell by the expression on that day trader’s face, CNBC thinks you should be worried. Very worried.

They warn readers:

Fears of slowing global economic growth, a hiking Fed and peak earnings have all weighed on Wall Street in recent months, putting the S&P 500 on track for its worst annual performance since 2008.

Classifying stock market performance as the “worst since 2008” is easy to do, considering the past decade has been maybe the GREATEST decade in history for investing.

It’s kind of like being called the shortest giant in the room.

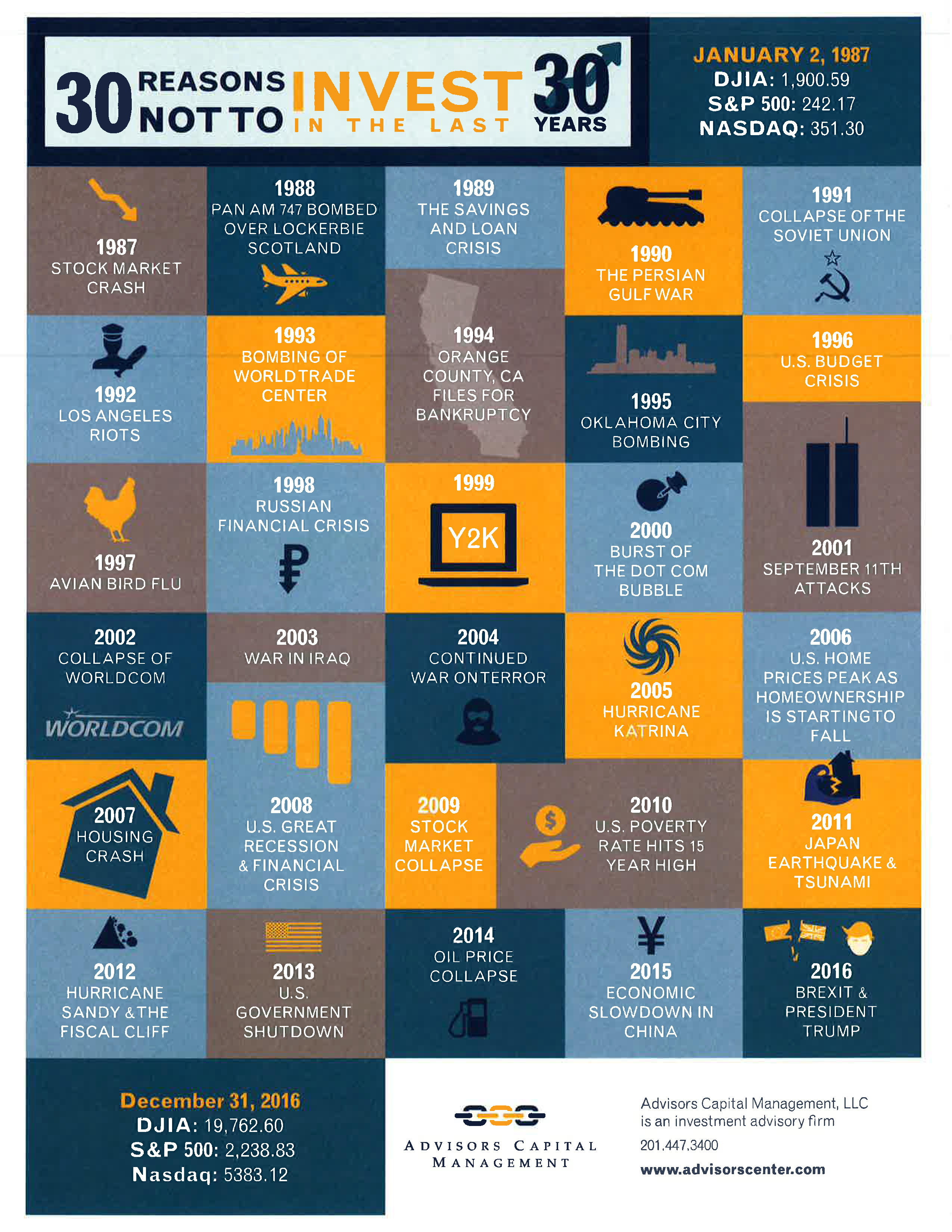

There are always reasons to fear investing in the stock market, and there always have been. Look at some of the biggest, scariest headlines of the past 30 years:

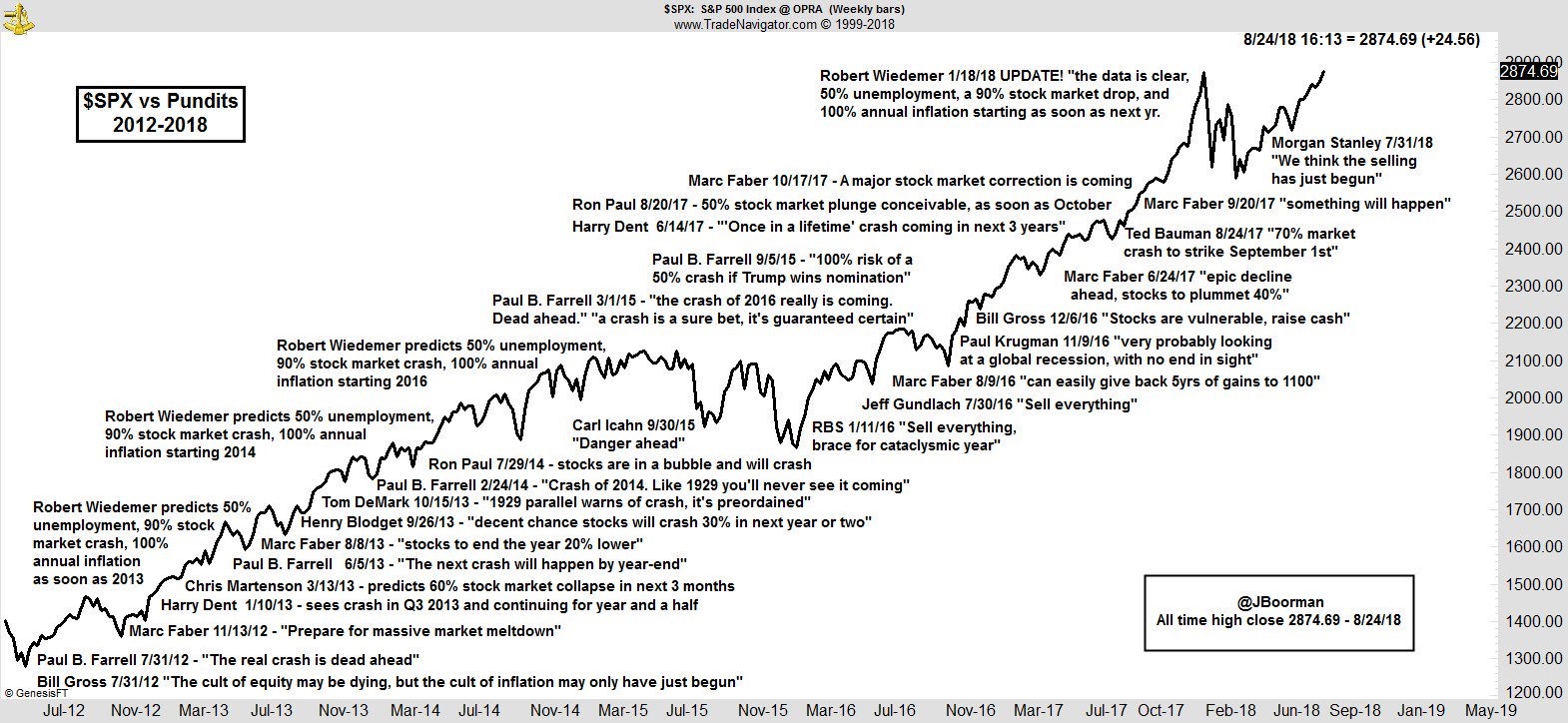

Predicting the next Great Depression is a favorite pastime of financial pundits.

After all, they need something to pass the time while America sits in the middle of the longest bull market in history. The United States is back open for business. Top line earnings are growing. Businesses are filling more orders, selling more widgets, and hiring more people.

SNOOZE. None of these facts make for very compelling “click-bait,” do they?

The quotes below are much better soundbites. Here are some of my favorite doomsday predictions from the “pouting pundits of pessimism” as the Dow continued its slow, inevitable climb to 26,000 (click image to zoom):

I feel particularly bad for anyone who subscribed to the newsletters of Marc Faber or Paul B. Farrell in the last 6 years.

Will the stock market finally have the 10-20% correction we’ve been waiting for? It could.

But if we have been meeting at least once a year, your portfolio should already be appropriate for your long and short-term liquidity needs.

If we haven’t been meeting once a year, turn off CNBC and let’s review your investment policy and asset allocation. The key to surviving regular market hiccups and the occasional 20 percent bear market is to make sure you have enough cash assets set aside.

In the meantime, repeat after me: Markets peak, and markets recover. Markets peak, and markets recover.

The stock market has always gone up- it just doesn’t go up every single day, month, or year. Your long-term investing success does not depend on the zigs and zags of the market. It depends on how you respond to them.