Today Marks the Longest Bull Market in History

Happy Anniversary!!!!

And I’m not just talking about the 30th anniversary of Bodnar Financial.

Today marks the 3,453rd day of the longest bull market in history, which began during the 2009 financial crisis and shows no signs of slowing down.

Coming out of the financial crisis, the U.S. was in a “growth recession.” We didn’t see a *BOOM* recovery, but the economy wasn’t necessarily bad. We saw about 2 percent gross domestic product (GDP) growth for years, which is nothing to write home about either way.

The American capitalist class had gone into red alert, cutting below-the-line expenses to create a profit and survive. As a result, they kept the lights on, but top line earnings remained low.

(Top line earnings refer to a company’s gross sales or revenues, rather than net profits. A company can increase its bottom line by cutting costs, but the real measure of its success is in top line growth. After all, getting more people to buy your stuff is much more lucrative -and fun- than budget cuts.)

Enter President Twitter. The Trump administration’s steady diet of tax cuts and deregulation added gasoline to the quietly smoldering economic coals left behind by President Obama.

Now, for the first time since the Financial Crisis, businessmen are looking at top line growth. They are filling more orders, selling more widgets, and hiring more people. The Atlanta Fed predicts a 4.3 percent rise in GDP this quarter.

* BOOM *

National Economic Council director Larry Kudlow says we are still in the early innings of this bull market. He told reporters, “It is possible that a, quote, real business growth cycle is right there in front of us for the next four, five, six years.”

Our friends on cable news, however, will tell you the storm clouds of a bear market are on the horizon. Every little dip in the market causes the pouting pundits of pessimism to point to the headlines and shout, “THIS IS THE BIG ONE!”

… Elon Musk, trade war fears, Turkey’s currency woes, the return of stock market volatility (did it ever go away?), an angry Iranian government, a Democratic electoral wave in 2018, a potential slowdown of corporate earnings by year-end…

We could fill an entire song to the tune of “We Didn’t Start the Fire” with things to worry about. But that’s kind of the point. There are always things to be worried about.

Could the market have a dip? Go down 2500 points? It could. In fact, it has every right in the world to do so, and personally I can’t figure out why it hasn’t.

But the market is beginning to inoculate itself to the doom and gloom of the 24-hour news cycle. The Dow Jones industrial average has become such a pessimist, it’s an optimist. It understands that as soon as the tiniest bit of negativity sneaks into the public psyche, some company’s earnings will come out and be at historic highs.

It’s enough to make you want to throw all your money into stocks, which ironically, is one of two things that can end this bull market:

- The Fed

We could see a small slowdown if the Federal Reserve makes some extreme interest rate hikes in the next few years. We’d have to see the fund’s rate get close to 3.5 percent in 2020, a significant change from our current 2 percent.

- Stock Market Euphoria

When investors get overexcited and everyone wants back into the market, the scales of stock market justice tip in the other direction. There become more buyers than sellers, and the market starts to slow down.

Given today’s media climate, it’s hard to imagine investors getting overly euphoric about the markets during a Trump presidency. We are currently in the middle of a huge bull market, and people STILL aren’t that excited about stocks. (Not even me!)

We are overdue for a stock market sell-off of 10 percent or more, but when will it come? We don’t know. The market doesn’t have a calendar.

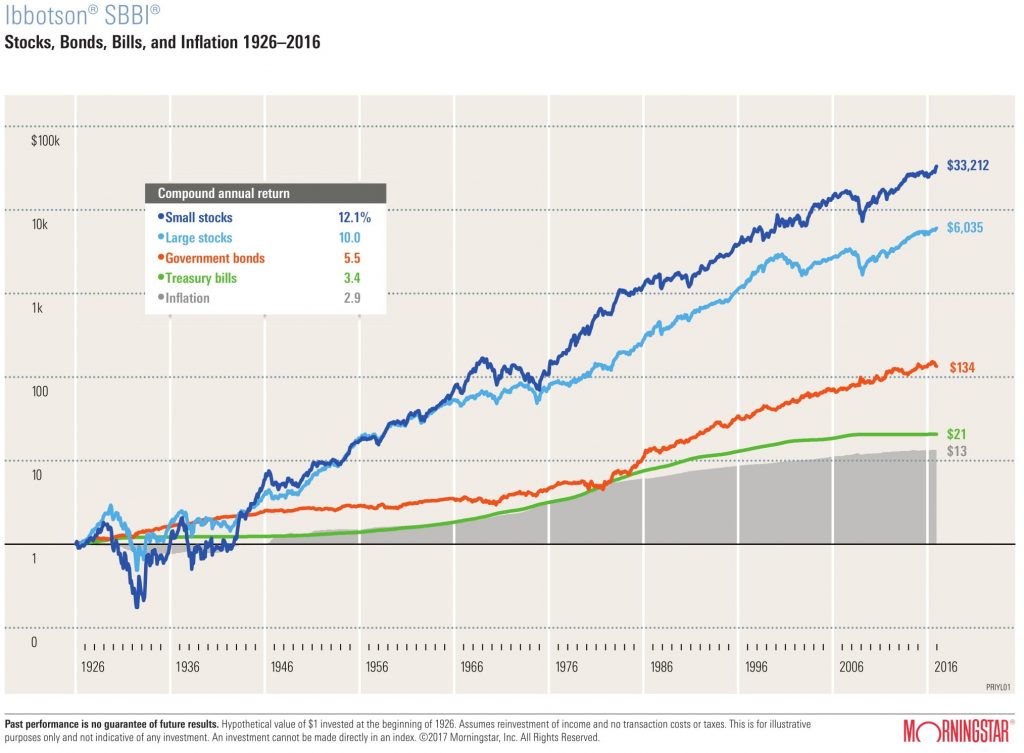

While we wait, join me in a Pledge of Allegiance to the Ibbotson chart below and take comfort in knowing the stock market has always gone up, it just doesn’t go up every day.