Worried Sick About Investing and Coronavirus? Time for A Lifeboat Drill…

On Friday, January 17, 2020—after a spectacular 40% run-up that started the day after Christmas 2018—the Standard & Poor’s 500-Stock Index closed at 3,329.62.

Two weeks later, to the day—Friday, January 31, 2020—the Index closed a little over three percent lower, at 3,225.52. (Indeed, more than half that damage was done on Friday.)

All of us have been invited by the financial media to suspect the blended value of 500 of the largest, best financed, most profitable businesses in America and the world have “lost” three percent (“with more losses to come!”)—due to the outbreak of coronavirus in China.

Permit me to doubt this, and to suggest that you, my fellow goal-focused, long-term investors, join me in doubting it. As I write this white paper, there have been 12 confirmed cases of coronavirus in the United States. You wouldn’t know it based on how laid back everyone is acting. (sarcasm)

The United States has declared the coronavirus a “public health emergency” and ordered a mandatory, two-week quarantine for all U.S. citizens returning from the center of the outbreak in China. People exiting planes from Wuhan around the world are being sprayed by foreign officials wearing hazmat suits on the tarmacs.

According to CNN, about 28,000 people have been infected in China. There have been an additional 170 confirmed cases reported worldwide—the same world that has a grand total of 7.8 billion people in it. For comparison, the CDC estimates that influenza has killed between 12,000 and 61,000 people in the U.S. each year since 2010.

I do not claim to have any idea how far this outbreak will spread, nor how many lives it will claim before it is brought under control. I’m reasonably certain that many (or perhaps most) of the world’s leading virologists and epidemiologists are working on it. I choose to believe their efforts will ultimately succeed. Clearly, this is nothing more than my personal opinion.

But if the extensive history of similar outbreaks in this century is any guide, this would seem to be a reasonable hypothesis. I draw your attention to:

- 2003-2004: SARS, also originating in China

- 2005-2006: The bird flu

- 2009: A new strain of swine flu

- 2014: The Ebola outbreak

- 2016-2017: The Zika virus

The coronavirus outbreak is not ideal, but we need to keep this in perspective before everyone starts panicking, forfeiting tickets to Broadway shows, canceling plans to visit family—and selling investments.

Will coronavirus worries lead to a recession?

On that first day of the litany of epidemics cited above, the S&P 500 closed at 855.70. Seventeen years and six epidemics later (including the current one), on Feb. 6, 2020, the Index closed nearly four times higher. I’m confident that you see where I’m going with this.

In the face of tragedy, geopolitical turbulence, disease outbreaks, you name it, the stock market always goes up—it just doesn’t go up every day. When the U.S. stock market dips on any given day, it simply means there were more sellers than buyers that day. But rest assured, the state of the U.S. economy is strong. Unemployment is down, wages are rising, and consumer comfort is at a 34-year high.

The coronavirus—and the fear surrounding it—will not cause a recession. But we ARE due for a market correction. Why? Because we typically see a 20-30 percent stock market correction every 5-6 years on average. Sell-offs are a normal part of market cycles, and we are due.

But then again, what do I know? I have been saying we could see a sizeable market correction for a couple of years now. And the stock market doesn’t own a calendar.

If a market correction is coming, what should I do?

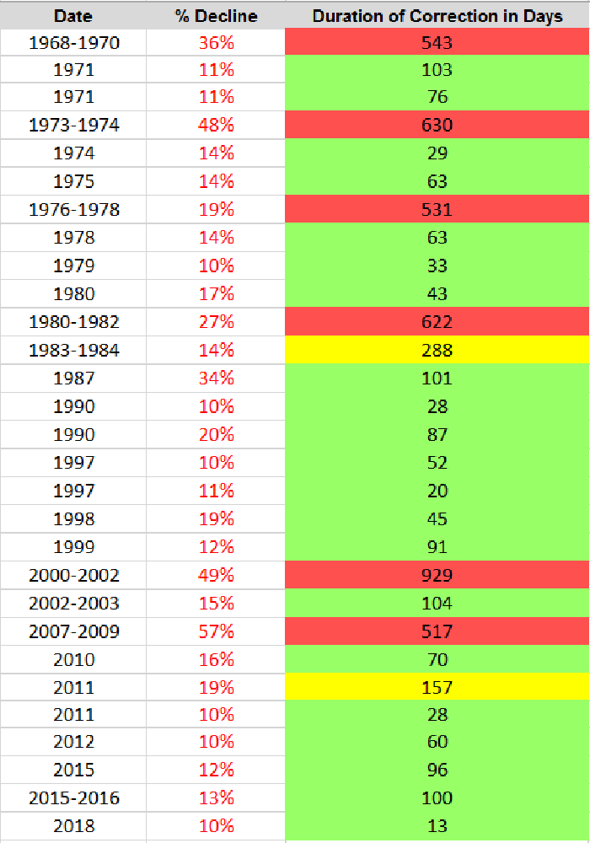

Stay cool-headed and focus on your long-term goals. Corrections may look scary (think about it: 10% of $1 million is $100,000!) but recoveries are often right around the corner. This table is a snapshot of every single market correction over the past 50 years, with the exception of last year. There have been about 29 total, varying in duration:

Twenty-one of the 29 corrections—more than 72 percent—lasted fewer than 105 days.

Seasoned Bodnar Financial clients already know, there is no way to predict the size or duration of the next market correction. However, history demonstrates that most of these drops only last a few weeks or months—rarely will they last a year or more. And they are almost always followed by a spectacular bull market.

In fact, some of the best recovery days can happen in close proximity to the worst days. For example, we remember 2008 as the height of the Financial Crisis. But for investors who had the courage to hold on, it had seven of the best 20 price return days for the Dow Jones Industrial Average Index since 1945. As my wife Karen often says, “don’t quit before the miracle happens.”

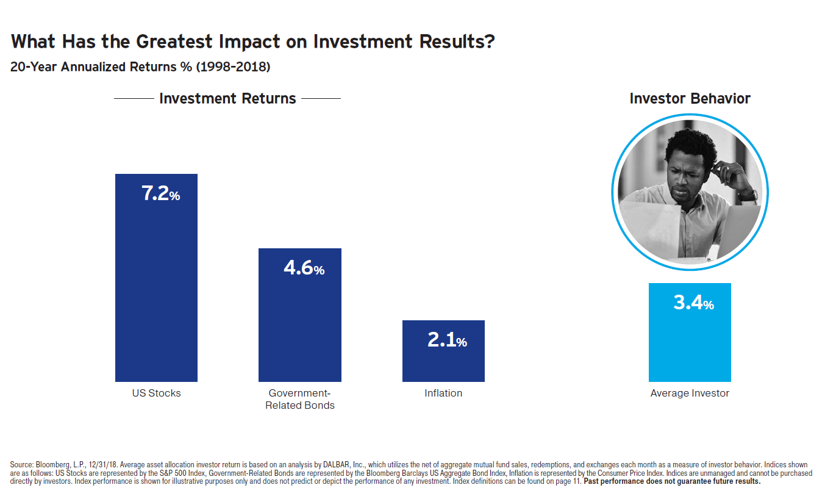

In my 30+ years in the financial advice industry, I have found the biggest threat to an investment portfolio is human emotion. The more often investors change their portfolios in response to market fears or fads, the worse their long-term results. Every successful investor I’ve ever known was acting continuously on a plan. Failed investors, in my experience, react to current events.

The famous DALBAR study supports my humble opinion on this topic each year:

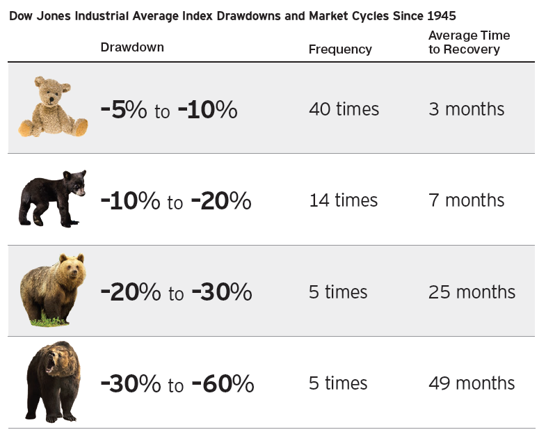

Markets don’t lose money. People lose money. As I’ve said in many missives’ past: the most responsible action investors can take is often no action at all, especially in the face of market volatility. To refresh your memory, this is what normal stock market volatility looks like:

Longtime clients may remember the lifeboat drill often referenced in past white papers. Perhaps it is time for another one. So, without further ado….. we interrupt this broadcast to provide a MANDATORY LIFEBOAT DRILL!

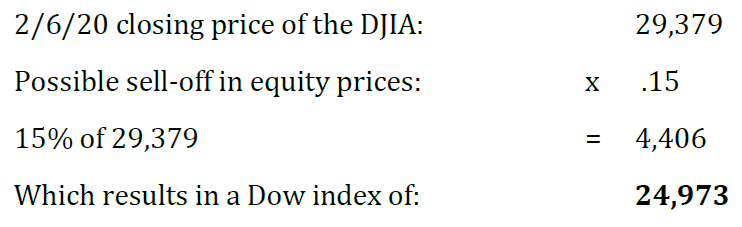

Sharpen your Ticonderoga and prepare for some very simple math. Lifeboat drills require that you actually do the math, so here we go:

The Dow drops 4,400 points to 25,000. Say that two times out loud…. The Dow drops 4,400 points to 25,000… the Dow drops 4,400 points to 25,000.

The financial pundits would have a field day predicting Armageddon. The market correction would eventually disappear, as mysteriously as it arrived. And it is my greatest hope that during that time—if this white paper has provided you with any value at all, my dear reader—you would have done absolutely nothing.

If we see a sell-off in 2020, here are some things to consider:

- Have we met in the past year? If not, schedule an appointment to make sure your asset

allocation is still appropriate for your age, cash flow, and liquidity needs. - Are you retiring soon? Let’s meet to discuss your retirement strategy, and make sure you

have enough cash available to meet your immediate needs. - Are you sitting on cash? Down markets present incredible buying opportunities. Scared

investors call low stock prices a disaster. Successful long-term investors call them a SALE!

I think the most helpful—and certainly most heartfelt—investment advice I can offer would be that you turn off the television set. Stay the course, so long as your long-term goals have not changed. And wash your hands! The regular, boring, old flu is no joke.

Want a printable version of this white paper? Click here